Asian shares inched up on Tuesday as manufacturing data around the world highlighted the drag on growth from the protracted euro zone debt crisis, raising expectations for the Federal Reserve to take further steps to underpin the fragile economy.

Manhattan community leaders began pressing Sunday for the cage around the iconic Charging Bull statue in the middle of New York's financial district to be removed.

While this week will be interrupted midway by the Fourth of July holiday, the barbecues and fireworks are unlikely to take away from the importance of Friday's June nonfarm payrolls report. Monday's ISM manufacturing index will also be in focus.

The U.S. Supreme Court on Thursday handed down its historic ruling on the Patient Protection and Affordable Care Act, largely upholding the law. But many fear that the ruling will result in a reduction in hiring and may become a further drag on our already struggling economy.

Disappointed by the lack of aggressive action by the U.S. Federal Reserve during the meeting of its powerful rate-setting committee last week, and expecting little more than rehashed promises from the leaders of Europe this week, pessimistic market-watchers are turning to once again guessing when the clock atop the Eurozone time-bomb will finally run to 0.

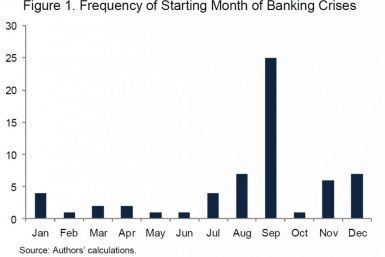

The Federal Reserve is charting a course for more stringent capital reserve requirements for the largest banking institutions in the U.S., in line with new international rules representing the Basel III accord.

It is just amazing how we never learn from other people's mistakes.

Central banks are reaching the limit of their ability to boost economic growth and the potential for harmful side effects of more extraordinary monetary easing is growing, the Bank for International Settlements warned.

The European Council's June 28-29 meeting will no doubt be the main focus of this week as some hope that new steps can be taken to grapple with the region's debt crisis.

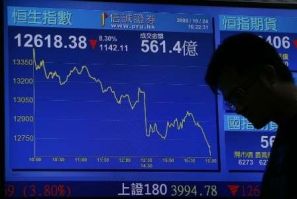

Most Asian markets fell this week as investors were worried after the U.S. Federal Reserve refused to announce a further round of quantitative easing and the HSBC Flash Purchasing Managers Index (PMI) indicated that China's manufacturing activity was faltering.

The price of gold was losing value on Thursday in as the U.S. dollar strengthened

U.S. stock index futures point to a higher open Friday, but investors are expected to remain watchful amid weak data across the globe following the downgrading of 15 global banks by ratings agency Moody's on Thursday.

Asian stock markets declined Friday, following a slump in the Wall Street overnight, as weak manufacturing reports from Europe, China and the U.S. dampened hopes for a global economic recovery.

Crude oil prices slightly advanced in Asian trading Friday, after plunging to their lowest level in eight months in the previous session.

Chinese market regulators announced Thursday they could be easing the rules that currently allow only a small group of foreign banks to invest in the national equity and bond markets, a move that is seen as part of a wider campaign to open the country's financial system to global competition. Whether by design or by coincidence, however, the move also takes a tremendous amount of pressure off the country's central bankers, who are between a rock and a hard place in deciding whether or n......

Yesterday the Fed announced that they will extend their yield curve 'twisting'

Manufacturing has been one of the few bright spots of the otherwise frail U.S. economic recovery, but Markit said weaker overseas demand could be starting to slow hiring in the sector. U.S. manufacturing grew in June at the slowest pace in almost a year and hiring in the sector also slowed.

Asian stock markets mostly declined Thursday as the Federal Reserve's limited help to bolster the domestic economy disappointed some market participants.

U.S. stock index futures point to a lower opening Thursday after the Department of Labor's initial jobless claims report, which showed that more people than expected filed for unemployment benefits, and the National Association of Realtors' report on existing home sales.

European markets fell Thursday as investors were disappointed the U.S. Federal Reserve failed to announce any quantitative easing measures on Wednesday.

Most Asian markets fell Thursday as investors felt let down by the U.S. Federal Reserve, which did not announce a further round of quantitative easing.

Asian stocks struggled and commodities fell broadly on Thursday after the Federal Reserve ramped up monetary stimulus by expanding Operation Twist, but disappointed some investors who had been hoping for more aggressive measures.