After the positive effects of the Greek election fade, markets will shift focus toward the Federal Reserve announcement scheduled for Wednesday.

Crude oil futures gained Monday after pro-bailout parties won a slim majority in Greece's general election over the weekend.

Asian stock markets advanced for the second straight week on expectations that major central banks in the world would act to tackle deteriorating global economic conditions.

There are fresh signs the U.S. economy may be caught in a storm fed by a floundering Europe and a slackening China. Weakening demand in both regions appears to be taking a toll on U.S. manufacturing, already the locus of a contracting workforce.

Manufacturing in the New York region hardly expanded in June as orders and sales cooled, the New York Federal Reserve's Empire State Manufacturing Survey showed Friday.

Stock markets in Hong Kong and China advanced Friday as weak U.S. economic data and worsening euro zone crisis raised hopes that the major central banks would act to tackle deteriorating global economic conditions.

Four years after the 2008 financial crisis began gathering steam, the government has collected another piece of the remaining billions in bailout money that it's owed.

U.S. 30-year fixed mortgage rates increased to 3.71 percent, reversing six weeks of declines after modestly positive economic data, mortgage financier Freddie Mac said Thursday.

Futures on major U.S. indices point to a slightly lower opening Wednesday ahead of the retail sales report and producer price index.

European markets rose Wednesday following an overnight rally in the Wall Street amid anticipation that the U.S. Federal Reserve would announce further quantitative easing to support the economy.

Stock markets in Hong Kong and China advanced Wednesday following an overnight rally in Wall Street overnight.

That massive pile of cash corporate America has been sitting on for years is shrinking, and the reason it's declining bodes well for the nation's economy.

The price of gold was flirting with the milestone value of $1,600 per troy ounce on Monday, but concerns about the euro debt crisis tempered the yellowish metal's advance, published reports state.

This week's data releases could reignite hopes that the Federal Reserve will soon provide more policy stimulus. May's producer price index and consumer price index should show that inflationary pressures are easing, with the latter falling below the Fed's 2 percent target rate. Retail sales and industrial production figures for May are likely to come in on the soft side, as well.

While the euro zone fiscal crisis has grabbed the spotlight, the U.S. faces its own fiscal crisis. The simultaneous onset of tax increases and spending cuts scheduled for Jan. 1 -- which will trigger unless Republicans and Democrats can agree on a balanced budget solution -- will likely send the economy plunging off a $720 billion fiscal cliff and into the arms of another recession.

Asian stock markets reported their first weekly gains in six weeks amid hopes that major central banks, including the U.S. Federal Reserve, might act to tackle deteriorating global economic conditions.

Without a stronger effort by the central banks -- in the form of a coordinated quantitative easing measure to correct the ailing European banking system -- the global economy (at best) will only limb along.

The Federal Reserve is proposing that U.S. banks, large and small, abide by a rigorous interpretation of an international capital standards agreement known as Basel III.

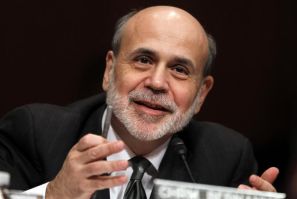

Crude oil futures declined Friday as the lack of explicit hints about further quantitative easing from Fed Chairman Ben Bernanke disappointed investors.

Japan's Nikkei 225 Stock Average fell Friday as lack of indications of more monetary stimulus in the U.S. by the Federal Reserve undermined the interest rate cut by China.

Global stocks rose Thursday after China unexpectedly cut its interest rate and continued rising even after Federal Reserve Chairman Ben Bernanke declined to commit to more economic intervention to boost the U.S. economy.

The price of gold on the New York Mercantile Exchange fell by more than 2 percent on Thursday, ending six days of consecutive price increases so far this month.