The number of Americans filing new claims for jobless benefits fell last week to near a four-year low, a hopeful sign for a labor market that has shown signs of weakness.

Asian stock markets advanced for the first time in five days on Thursday as disappointing U.S. housing data boosted hopes for further monetary stimulus from the Federal Reserve.

Asian markets rose Thursday amid hopes that central banks all over the world would soon announce stimulus measures to tackle the weakening global economy.

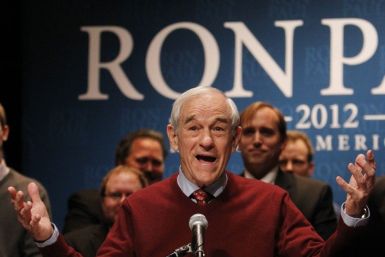

Ron Paul's so-called "Audit the Fed" bill, aimed at making the U.S. Federal Reserve more transparent and accountable, passed the U.S. House of Representatives in a rare moment of bipartisanship on Wednesday.

Millions of Americans have gone broke by buying their dream home and now financial innovation is needed to help savers and mortgage holders get out of debt.

By taking policy rates to close to 0 percent and pushing deposit rates below zero, the move by Denmark may have opened the window for the ECB to take action at their meeting next week.

For the last three years, the consensus has been that a robust and self-sustaining recovery for the U.S. economy is on the cards, but economist Nouriel Roubini, dubbed Dr. Doom, thinks that it's not likely to happen, rather he expects below trend growth for many years to come.

In a fairly light week of data, Friday's first take on the U.S. second-quarter gross domestic product will be the main event. Economists expect a feeble reading of 1.4 percent. This will be the final major data point to influence participants at the July 31 - Aug.1 meeting of the policy-setting Federal Open Market Committee.

Asian markets were mixed this week as investors continued to have concerns about the faltering global economy and the mounting debt crisis in the euro zone.

As U.S. President Barack Obama shifts the focus of his re-election campaign from joblessness to income inequality, unemployment has increased in more than one-half the country's states this year.

U.S. consumer spending will grow at a meager rate of 1.5 percent to 2 percent by the end of this year, Sterne Agee, a U.S. brokerage and investment firm said on Friday in a report.

The Federal Reserve Bank of New York is proposing that money market managers be empowered to hold back depositors' money for 30 days in the event of a run on funds. The controversial proposal is being called by critics a kind of capital control.

Most European markets fell Friday amid the revival of investor concerns about the global economy affected by the debt crisis in the euro zone.

Gold continues to fare better than other asset classes in spite of a downward pressure on prices.

U.S. Treasury Secretary Timothy Geithner appeared on a CNBC-sponsored conference Wednesday morning toeing the government's party that the New York Fed is not to blame for helping keep the evolving LIBOR rate-fixing scandal under wraps, even though they knew it was going on since at least 2007.

U.S. stock index futures point to a higher opening Thursday as corporate earnings reported for the second quarter exceeded expectations, indicating that business conditions are on the path of revival.

Asian markets rose Thursday as investors were encouraged by healthy earnings reports from the U.S. companies which alleviated concerns of faltering business conditions.

Asian shares rose Thursday as strong corporate profits from U.S. bellwethers allayed fears of a slowdown in earnings while the euro steadied after being hit by reported comments from German Chancellor Angela Merkel that rekindled fears about the euro zone debt crisis.

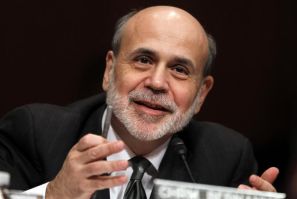

The Federal Reserve said Wednesday that the U.S. economic activity increased at a modest to moderate pace in June and early July as more districts are reporting slowing growth.

The recession and housing crash have triggered a sharp decline in the share of American households who own their own home. Homeownership, which is at its lowest point in 15 years, is bound to fall even further, driven by tight credit, lackluster economic growth and more foreclosures.

Seeking to avoid another extension of Bush-era tax cuts for the nation's top earners, Senate Democrats unveiled a plan to let tax breaks expire for all Americans and then implement a separate tax cut for middle-class Americans.

U.S. stock index futures point to lower opening Wednesday as investors were disheartened after the Federal Reserve gave no indication of stimulus measures to boost the economic growth.