American International Group shares rose nearly 7 percent to a one-year high on Wednesday on news that it could reap billions of dollars from asset sales in the near future.

Trading on nonpublic information is already illegal for House and Senate members, but the new law bars them and any other federal employee from trading on nonpublic information about upcoming legislation or regulations. It also tightens disclosure requirements on financial transactions.

Wall Street stocks were looked likely to open lower open on Wednesday, despite good private sector payrolls data, as investors digested minutes from the latest Federal Reserve meeting published Tuesday suggesting further monetary stimulus action is unlikely.

Crude oil prices declined in Asian trade Wednesday as the Federal Reserve released minutes from a recent meeting dashed hopes for a fresh dose of quantitative easing (QE3) in the near future.

She didn't mention the U.S. central bank's two previous rounds of bond-buying known as quantitative easing, but Lagarde stressed that past action by the Fed and European regulators helped keep growth strong and steady.

The U.S. economy likely notched up a fourth month of solid job growth in March, which would lower the need for the Federal Reserve to offer additional monetary stimulus to spur faster economic growth.

The U.S. economy likely notched up a fourth month of solid job growth in March, which would lower the need for the Federal Reserve to offer additional monetary stimulus to spur faster economic growth.

Investors re-adjusted their value calculations for risky assets on Tuesday, selling off stocks, bonds and all manner of commodity futures after the Federal Reserve released minutes from the most recent meeting of its rate-setting committee. The minutes strongly suggested that the U.S. central bank was backing away from the possibility of further monetary easing in the short-run, including any kind of quantitative easing.

Federal Reserve policymakers appear less keen to launch a fresh round of monetary stimulus as the U.S. economy improves, according to minutes for the central bank's March meeting.

Gold held near $1,675 an ounce on Tuesday as investors took to the sidelines ahead of the release of minutes from the Federal Reserve's latest policy meeting, which will be closely watched for clues on the direction of monetary policy.

Stocks were set to take a breather on Tuesday after the S&P 500 climbed to a 4-year high and ahead of factory orders data and minutes of the latest Federal Reserve meeting.

Stock index futures fell on Tuesday after the S&P 500 climbed to a 4-year high in the previous session as investors awaited factory orders data and minutes of the latest Federal Reserve meeting.

Futures on major US stock indices point to a slightly lower opening Tuesday as investors awaited the report on factory orders and minutes of the latest Federal Reserve's Federal Open Market Committee (FOMC).

Gold prices rose above $1,680 an ounce on Monday as the dollar steadied off earlier one-month highs against the euro, with the U.S. unit further paring gains after U.S. construction spending and manufacturing data.

Gold prices will continue to rise steadily throughout the next 12 months, as long as the U.S. economy maintains its tepid recovery, according to a note recently released by Goldman Sachs Group Inc.

The BRICS nations met for a summit in New Delhi, where, among other subjects, they discussed the possible formation of a joint development bank, closer integration of their respective stock exchanges, energy security and ongoing tensions in the Middle East. But they still wield no power as a bloc, says an expert who has studied the BRICS phenomenon

The U.S. nonfarm payroll report on Friday will highlight the economic calendar this week -- April 2 to 6 -- even though it will be released on Good Friday when the stock market is closed.

The Chicago Purchasing Managers' business barometer, commonly known as the Chicago PMI, for March dropped to 62.2, down from 64.0 in February and below analyst expectations of 63.0.

Household income grew at a faster pace in the fourth quarter than previously thought as the jobs market strengthened, a development that could underpin consumer spending.

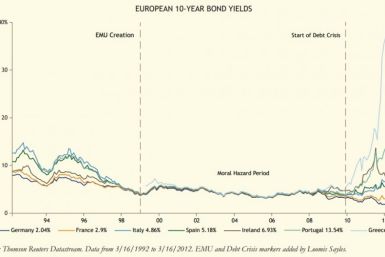

The perception, driven by bonds' performance, that the euro's success would continue unabated was shattered beginning in October 2009, when Greece’s 10-year yields soared to 10.3 percent. Today, U.S. policymakers may be making the same mistake in failing to recognize threats of a coming financial crisis.

Containing inflation will be critical when the time finally comes for the U.S. Federal Reserve to reverse its ultra loose monetary policy, two top Fed officials said on Thursday.

Federal Reserve Chairman Ben Bernanke said on Thursday that he expects the U.S. economy to return to a long-term growth rate around three percent over time.