In Sweden, monetary transactions made with physical cash are down to three percent of the national economy... and the rest of the world may be closer to cashless than you think.

The conclusion is that the equity market is cheap relative to earnings. Hence, the market is priced to absorb a potential softening in earnings rather than being priced to perfection.

The Federal Reserve has not yet decided whether to embark on a third round of quantitative easing, or QE3, though it remains an option, an influential Fed official said on Monday.

The U.S. Federal Reserve has not yet decided whether to embark on a third round of quantitative easing, or QE3, though it remains an option, an influential Fed official said on Monday.

The fall in gold prices has prompted one or more central banks to buy as much as four tonnes of bullion in recent weeks, according to an industry source and a Financial Times report on Friday.

The head of the Federal Reserve's New York branch said the U.S. economy isn't in the clear yet, but recent data have been a bit more upbeat, giving investors renewed hope of a fresh round of quantitative easing.

European markets lost ground as the lack of positive catalysts prompted a pause in the recent string of gains, while Asian stocks were mostly higher.

To date, the 2012 Republican Party presidential-nomination process has been dominated by a faction that wants to nominate a conservative, but the least conservative candidate remains the GOP’s strongest: Mitt Romney.

The Federal Reserve bank said on Friday it had made mistakes in calculating bank losses in stress test results released this week.

You can't blame investors for feeling a bit squeamish regarding deploying new money in the U.S. stock market these days, despite the Dow Jones Industrial Average's (DJIA) recent rise to 13,000. Where's the Dow headed in the next three months?

Stocks were flat on Friday as data showed inflation remained in check last month as the domestic economy continues to improve, but consumer sentiment slipped.

The pace of manufacturing growth in the Philadelphia region slowed in March but remained positive, as new orders dipped substantially, according to a Philadelphia Fed survey released Thursday.

Claims for jobless benefits fell back to a four-year low of 351,000, providing more evidence that the labor market is healing.

Citigroup Inc on Wednesday stood by its pledge to reward shareholders, as Wall Street sought to understand why the bank failed to win approval from regulators to increase its dividend or buy back stock.

Shares of Citigroup (NYSE: C) fell more than 4 percent Wednesday after the Federal Reserve said the No. 3 U.S. bank flunked a “stress test” of its financial viability.

Developed economies will pick up steam this year thanks to an array of ultra-loose monetary policies from major central banks and amid new signs of progress in the euro zone's debt crisis, a Reuters polls found.

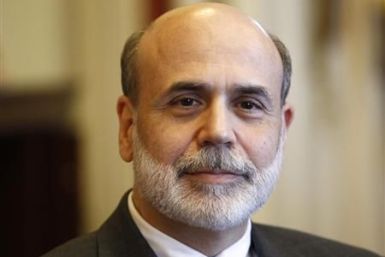

The Fed chairman said smaller banks are getting stronger despite the slow U.S. recovery, and he assured community bankers that the sweeping financial regulatory overhaul of 2010 is aimed at much bigger players.

The Federal Reserve will try to make it clearer whether new banking rules apply to small lenders, Federal Reserve Chairman Ben Bernanke said in remarks on Wednesday.

The Federal Reserve will try to make it clearer whether new banking rules apply to small lenders, Federal Reserve Chairman Ben Bernanke said in remarks on Wednesday.

The Federal Reserve will try to make it clearer whether new banking rules apply to small lenders, Federal Reserve Chairman Ben Bernanke said in remarks on Wednesday.

The companies whose shares are moving in pre-market trade on Wednesday are: Francesca's Holdings Corp, Zions Bancorporation, Regions Financial Co, RADVision Ltd, Clearwire Corp, LSI Corp, SunTrust Banks, Citigroup, American Capital Mortgage Investment Corp and Fifth Third Bancorp.

Most of the largest banks passed their annual stress test, the Federal Reserve revealed in an earlier-than-expected release of the results, after JPMorgan Chase pulled the trigger on announcing its glowing marks and helped lift the stock market.