A U.S. judge has appointed a trustee to oversee the liquidation of the U.S. brokerage unit of Jon Corzine's MF Global Holdings Ltd, which filed for bankruptcy protection on Monday, a federal agency said.

The financial risk council held a conference call on Monday to discuss developments related to MF Global Holdings Ltd, according to a Treasury Department official.

Stocks fell at the open on Monday as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

As the Occupy Wall Street movement head into its seventh week, Richmond police put an end to protests in Kanawha Plaza.

Stocks fell at the open on Monday as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

Oil prices eased on Monday, with Brent slipping below $110, as the dollar rose against the yen after Japan intervened in the currency markets to stem the rise of the yen.

The yen dropped to a three-month low against the dollar on Monday after Japan intervened in the market to curb the currency's rise even as traders said more official action is needed for a sustained impact.

The New York Fed suspended MF Global from conducting new business with the central bank on Monday and its shares were suspended, as the troubled brokerage nears a deal on its future.

Asian shares fell Monday and commodities slipped as the dollar spiked to a three-month high against the yen following Japan's intervention, prompting investors to book profits after last week's rally.

Gold prices dropped about 2 percent on Monday, after Japan's intervention in the currency market triggered a rapid rally in the dollar, spooking precious metals investors.

U.S. and European shares took a breather on Friday after a strong rally on a long-awaited euro zone rescue deal, but a weak sale of Italian bonds showed investor confidence in the agreement was shaky.

The head of the European Financial Stability Facility sought to entice China on Saturday to invest in the bailout fund by saying investors may be protected against as much as one-fifth of initial losses.

Diversified financial services firm Wells Fargo & Co. (NYSE:WFC) said it is cancelling its planned five-state pilot of a monthly $3 fee for users of its debit cards as a response to customer feedback the bank has received.

A controversial weapon could be deployed soon in the U.S. fight against the housing crisis as states and top banks near a deal in their dispute over mortgage abuses -- cutting the mortgage debt owed by homeowners.

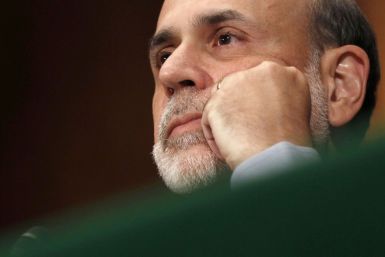

The ink is barely dry on European leaders’ plan to resolve the Greek / Europe debt crisis, and attention has already turned to the U.S. Federal Reserve. Is there enough liquidity in the global financial system or will Fed Chairman Ben Bernanke need to deploy more monetary stimulus to grease the wheels of commerce?

European leaders are negotiating with Greek bondholders, publicly stating investors will have to take substantial losses. Their stance is in stark contrast to the way debt holders have been coddled in programs managed by the U.S. Federal Reserve

The Volcker rule has created a new battlefield over Wall Street pay that banks fear will send their star traders and hedge fund advisers fleeing.

President Barack Obama Wednesday is expected to announce the details of a new student loan repayment initiative aimed at easing the heavy debt many college graduates face.

Investors stayed cautious ahead of a summit expected to deliver pledges to tackle the euro zone's debt crisis rather than firm commitments, keeping the euro above $1.39 as stocks markets traded little changed.

The weak housing sector continues to pose a strong headwind to the economic recovery, and the Federal Reserve could potentially do more to drive down mortgage rates to support the sector, an influential Federal Reserve official said on Monday.

New York Federal Reserve President William Dudley said on Monday the U.S. economy still faces serious headwinds, including spillover effects from Europe, adding the central bank will continue to do everything within its power to help.

S&P 500 index futures were little changed on Monday as European policymakers differed over the size of sovereign debt losses that private bondholders will have to accept, but strong earnings from Caterpillar put a floor on losses.