The Federal Reserve's move last week to further lower borrowing costs was risky and won't significantly speed up a painfully protracted recovery, one of the officials who dissented against the decision said on Thursday.

The Federal Reserve's move last week to further lower borrowing costs was risky and won't significantly speed up a painfully protracted recovery, one of the officials who dissented against the decision said on Thursday.

Stock index futures rose on Thursday after a German vote approving new powers for the euro zone's crisis fund was approved and before data on U.S. economic growth and the labor market.

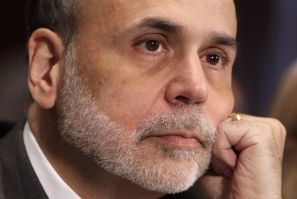

U.S. Federal Reserve Chairman Ben Bernanke said Wednesday the United States should take a que from robust emerging market economies and support strong GDP growth through responsible fiscal policy.

U.S. Federal Reserve Chairman Bernanke speech Wednesday at the Cleveland Clinic 'Ideas for Tomorrow' Series:

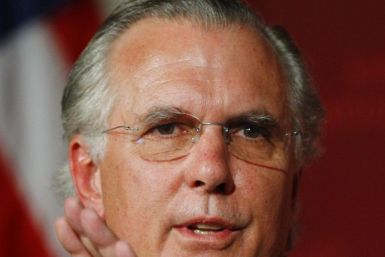

The Federal Reserve's new Operation Twist drew a number of objections from Richard W. Fisher, president of the Federal Reserve Bank of Dallas, who explained his opposition to the move in a speech Tuesday.

The U.S. economy is on a knife edge between growth and contraction, and if it were a dashboard, it would be flashing watch out, danger ahead on all gauges, Dallas Federal Reserve Bank's top economist said on Tuesday.

Two top Federal Reserve officials on Monday defended the central bank's most recent effort to boost growth, and one suggested further steps may be justified.

Two top Federal Reserve officials on Monday defended the central bank's most recent effort to boost growth, with one suggesting further steps may be justified.

Expanded Federal Reserve efforts to boost tepid growth and cut high unemployment are justified as broken housing markets and depleted household wealth act as a brake on the recovery, a top Fed official said on Monday.

Paul's message of limited government, and Federal Reserve/money supply critiques will receive some air time on Jon Stewart's The Daily Show.

Expanded Federal Reserve efforts to boost tepid growth and cut high unemployment are justified as broken housing markets and depleted household wealth act as a brake on the recovery, a top Fed official said on Monday.

So maybe Herman Cain is the secret weapon the Republican party had all along in the bid to take down Democrat Barack Obama. Republicans just didn't know they it.

The Dow Jones industrial average on Friday suffered its worst week since the depths of the financial crisis in 2008, stung by severe anxiety over Europe's spiraling debt crisis and a warning from the Federal Reserve about the U.S. economy.

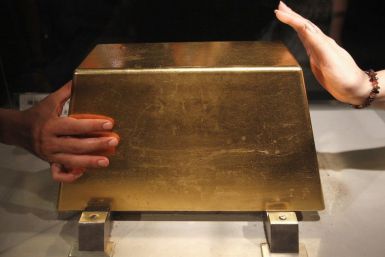

Gold prices slumped more than $100 an ounce on Friday, the biggest fall on record in dollar terms, as traders sold to cover losses, while global stocks edged up on expectations the European Central Bank will take new measures to contain the euro zone debt crisis.

Just days after the Federal Reserve launched a new round of unconventional monetary policy easing, a top Fed official with a record of supporting such moves on Friday questioned how effective the latest move will be.

Gold crashed more than $100 lower on Friday as a slide turned into a freefall, with weeks of volatility, renewed strength in the dollar and talk of hedge fund liquidation wrecking its safe-haven status.

Let's face the mounting facts and just say it in plain language: The world is slipping into Global Recession 2011 and governments don't have the gunpowder to ward it off. The U.S. economy is barely growing at all. Companies aren't hiring. The federal budget deficit is above $14.5 trillion. Companies are stockpiling cash because, as Ford CEO Alan Mulally said in a press conference this week, because the consumer has pulled back.

Gold prices plummeted Friday, at one point tumbling to 15 percent below the level of three weeks ago, as investors started buying stocks and, to a lesser extent, euros. Silver is now down 25 percent from its mid-week level.

Still burdened by an ongoing phone-hacking scandal at its British subsidiaries, Rupert Murdoch's company is aggressively buying back shares in an effort to buttress its share price. Assuming the shares remain at about $17, one analyst estimates News Corp. will have repurchased almost $2.2 billion in shares by as early as Nov. 7.

The Dow Jones Industrial Average (DJIA) is on track to record a weekly decline of more than 800 points -- its worst weekly swoon in two years. But the important question for the typical investor is, 'Where's the Dow likely to head in the next six months?'

Gold prices fell about 3 percent Friday, setting up the third weekly decline for what has recently been touted as the pre-eminent safe haven.