Ralph Nader is a five-time candidate for President of the United States, with a particular concern for consumer protection, eviromentalism and democratic goverment. Some claim the lecturer and attorney has been merely a political disrupter over the years, acting as a third-party spoiler for instance in the 2000 U.S. presidential election.

New U.S. jobless claims rose unexpectedly last week, further evidence of a weak labor market just hours before President Barack Obama delivers a major address to Congress on the issue.

A rebound in Asian stocks ran out of steam Thursday as worries over the widening euro zone crisis and the faltering U.S. economy undermined investor confidence.

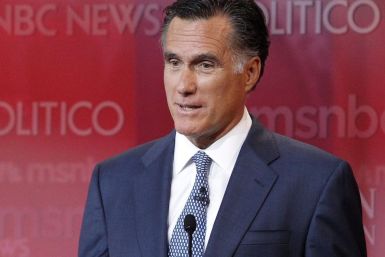

Republican presidential candidates met at the Ronald Reagan presidential library in Simi Valley, California, on Wednesday for a televised debate.

Republican presidential candidates gather at Ronald Reagan's library in California on Wednesday for the first in a series of debates over the next six weeks that will help define the Republican race.

Republican presidential hopeful Mitt Romney said on Wednesday that if he were elected president, he would not keep Ben Bernanke as chairman of the Federal Reserve.

Anyone expecting Federal Reserve Chairman Ben Bernanke to outline bold new measures to boost flagging U.S. growth on Thursday is likely to come away disappointed.

U.S. Treasury debt prices fell on Wednesday as traders booked profits from a recent rally and higher stocks undermined the safe-haven value of U.S. government debt.

The sluggish U.S. recovery failed to gain speed in recent weeks and softened in some areas of the country, as volatile stock markets and sputtering factory activity weighed on growth, the Federal Reserve said on Wednesday.

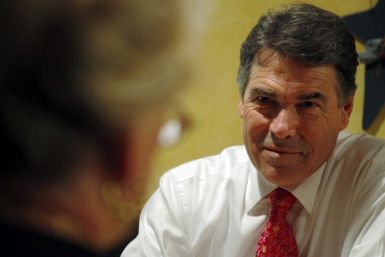

Texas Gov. Rick Perry is under attack by Rep. Ron Paul, as the congressman and presidential candidate points to Perry's less that tea-party past.

The sluggish recovery failed to gain any speed in recent weeks and softened in some areas of the nation, the Federal Reserve said on Wednesday.

The sluggish recovery failed to gain any speed in recent weeks and softened in some areas with factory activity sputtering and retail sales under pressure, the Federal Reserve said on Wednesday.

In a dramatic policy shift, the Bank of Canada said on Wednesday it saw less need to raise interest rates, becoming the latest major central bank to take a more cautious stance about the worsening global economy.

A previous article looked at 10 positions that could make Perry unelectable once he has to win over the general electorate rather than just Republican voters. On the flip side, here are five reasons he could have a good chance.

In a flight to safety, the 10-Year Treasury yield has fallen below 2.00 percent, while gold futures are slightly higher.

Asian shares fell and U.S. Treasury yields dropped to the lowest levels in at least 60 years on Tuesday on fears that Europe's sovereign debt troubles are worsening and could trigger a second full-blown banking crisis.

Texas Gov. Rick Perry, the latest frontrunner for the Republican presidential nomination, has taken more radical stances than perhaps any other candidate. Here are the top 10 positions that may make it difficult for him to compete in the general election.

To say it's been a discomforting time for U.S. stock investors lately would be an understatement. Europe debt concerns, a tepid U.S. economic recovery that’s not creating enough jobs, and now Hurricane Irene’s damage has jolted institutional investors. Given the above, where’s the Dow headed from here?

Paul assured he will run as a Republican, not as a third-party independent.

Wall Street sees an 80 percent chance the Federal Reserve will intervene in the bond market to lower long-term interest rates, according to a Reuters poll, after a report showed the U.S. jobs crisis deepened in August.

U.S. government bond investors see Federal Reserve action to boost the flagging economy as practically a done deal after Friday's dismal jobs report.

A darkening U.S. economic outlook is forcing Federal Reserve officials to dig ever deeper into an already depleted policy toolkit and consider measures until recently deemed too radical.