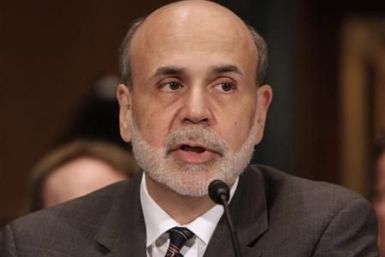

The Dow Jones Industrial Average plummeted in Thursday trading, dropping more than 3 percent at certain times after Federal Reserve chairman Ben Bernanke introduced Operation Twist to jump-start the slumping economy.

The U.S. Federal Reserve intervened in the U.S. economy Thursday – the central bank did what investors thought they would do, but the Dow Jones Industrial Average still fell more than 270 points. What’s going on?

China's manufacturing sector contracted for a third consecutive month in September while a measure of inflation picked up, suggesting the world's No.2 economy may not be able to provide much of a counterweight to flagging U.S. and European growth.

U.S. stocks have opened sharply lower in Thursday morning trading following an overnight plunge in global markets. Equities have tumbled largely in response to the Federal Reserve’s grim warning about the state of the U.S. economy and the establishment bond swap program.

Foreign equities tumbled largely in response to the Federal Reserve’s grim warning about the state of the U.S. economy.

Commodities skidded on Thursday as investors scrambled to liquidate after a U.S. Federal Reserve warning, coupled with signs of slower growth in China and Europe, stoked worries about slowing demand for fuels and metals.

Gold prices plummeted more than 3 percent Thursday after the Federal Reserve pronounced the economy seriously ill but then prescribed what many traders and analysts saw as a virtual aspirin.

Gold fell on Thursday, after the Federal Reserve's widely-anticipated move to boost U.S. growth lifted the dollar but pummelled global equities and hit the entire commodities complex.

Spot gold slipped on Thursday under the weight of a rallying dollar, after falling more than 1 percent in the previous session when the U.S. Federal Reserve announced its plan to load up long-term securities and offered a grim economic outlook.

A grim outlook for the U.S. economy from the Federal Reserve and signs of a slowing China and Germany drove world stocks sharply lower on Thursday and pushed investors into safer currencies and government bonds.

Europe's debt crisis is the biggest threat to the global economy, the Treasury said on Wednesday, and it called on European policymakers to provide unequivocal support to banks and governments under stress.

Global Economic Crisis: Are we Better or Worse off than 2008? The Greek economic crisis is at the heart of the problems of the world economic crisis and for as long as France and Germany continue to ignore the realities that Greece must be allowed default on its debts, the European and world economies will suffer the consequences.

Stock index futures pointed to a lower open on Wall Street, with futures for the S&P 500, Dow Jones futures and Nasdaq 100 futures down between 1.4 to 1.8 percent at 0923 GMT.

World stocks hit a fresh one-year low on Thursday and investors poured money into safer currencies and government bonds after the Federal Reserve gave a grim outlook for the U.S. economy and China's manufacturing slowed.

FedEx Corp is seen reporting higher quarterly results than a year ago on Thursday, but analysts are more keen to see if the No. 2 package delivery company cuts its full-year guidance because stalled global economic growth has stifled volume.

The Federal Reserve on Wednesday warned of significant risks to the already weak U.S. economy and launched a new plan to lower long-term borrowing costs and bolster the battered housing market.

The Federal Reserve on Wednesday moved to counter what it said were significant risks to the U.S. economy with an effort to lower long-term borrowing costs and bolster housing.

The Federal Reserve on Wednesday ramped up its aid to the beleaguered U.S. economy, launching an effort to put more downward pressure on long-term interest rates and increase its support for housing.

Stocks plunged late Wednesday after the Federal Reserve announced it will sell $400 billion worth of short-maturity bonds and reinvest in bonds with maturities of six to 30 years in the coming year. The program has been commonly referred to as Operation Twist.

The U.S. Federal Reserve Wednesday announced it will sell $400 billion worth of short-maturity bonds and reinvest in bonds with maturities of 6 to 30 years by the end of June 2012, in a program commonly referred to as Operation Twist.

Gold fell on Wednesday as investors booked profits on the metal's rally earlier in the day ahead of the outcome of a Federal Reserve policy meeting that many hope will confirm the central bank's strategy to kick-start U.S. growth.

Stocks drifted lower on Wednesday as investors were reluctant to place bets ahead of a U.S. Federal Reserve announcement that is expected to present some action to speed up a lagging recovery.