Futures on major U.S. stock indices point to a lower opening on Wednesday with futures on the S&P 500 down 0.47 percent, futures on the Dow Jones Industrial Average down 0.39 percent and Nasdaq100 futures down 0.47 percent.

Yields on U.S. Treasuries climbed to seven-month highs in Asia on Wednesday and the dollar rebounded as upbeat retail sales data added to evidence that America's economy is gathering steam.

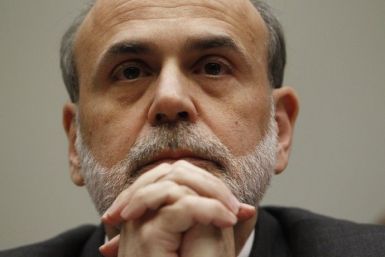

Stocks retreated in the final hour of trading after the Federal Reserve left interest rates unchanged at near-zero, maintained its bond-buying program and warned about the slow pace of economic recovery in the U.S.

The Federal Reserve on Tuesday offered only a cautious nod to the economy's improving prospects as it put a spotlight on lofty unemployment and reaffirmed its commitment to buy $600 billion in bonds.

The economic recovery is continuing, but at a pace that is not sufficient to bring down unemployment, according to a policy statement by the Federal Reserve’s Federal Open Market Committee (FOMC).

The Federal Reserve on Tuesday offered only a cautious nod to the economy's improving prospects as it put a spotlight on lofty unemployment and reaffirmed its commitment to buy $600 billion in bonds.

Short-term interest rate futures traders kept expectations the Federal Reserve will wait to hike rates until late 2011, after the U.S. central bank reaffirmed its commitment to provide stimulus to the economy.

U.S. retail sales continued to rise in November for the fifth month, boosted by holiday shopping as well as fuel prices, the U.S. Commerce Department said.

The British pound strengthened on Tuesday on a higher-than-expected inflation reading for November, with the sentiment also supported by a view that the US Federal Reserve may expand its bond buyback program at its monetary policy later in the day, supplying more dollars into the system.

Dollar Libor rates were steady on Tuesday as Federal Reserve officials met to assess their controversial bond buying program against a backdrop of fresh tax cuts that could lift U.S. economic growth.

A survey conducted by Association for Financial Professionals showed the executives do not believe that additional fiscal stimulus is necessary or desirable at this stage.

The dollar fell to a three-week low against the euro and Treasuries steadied ahead of a Federal Reserve policy meeting on Tuesday, while stocks held near a two-year peak, supported by optimism over Chinese growth.

China is stepping up its efforts to contain inflation, even as the latest economic report indicates that inflation hovers around a 28-year high of 5.1 percent in November.

Economists are more positive about economic growth in 2011 in the United States, according to a survey by the Wall Street Journal.

China has stubbornly refused to cede to U.S demands to let the yuan rise against the dollar. The question is, among the US and China who will gain and who will lose if China ever agreed to appreciate its currency?

There are plenty of concerns surrounding U.S. Treasuries, yet a Treasury crisis doesn't seem to be happening.

The potential expiration of the Build America Bond (BAB) program at the end of this year may have a negative near-term impact on the prices of the overall municipal bond market.

European equities will beat 2010 gains by the end of next year, as companies get some help from better earnings and record-low interest rates that will overcome the sovereign debt crisis, Bloomberg said, citing a survey of 13 strategists.

Stocks finished narrowly mixed in lethargic trading as an early jump on a benign jobless claims data faded away on a stronger U.S. dollar and later on news that Democrats in the House voted against considering the tax cut extensions that President Obama negotiated with Republicans.

Foreign central banks' overall holdings of marketable securities at the Federal Reserve fell in the latest week, data from the U.S. central bank showed on Thursday.

Insurance giant American International Group has signed a debt repayment deal with Federal Reserve Bank of New York, paving way for the Treasury Department to sell a significant stake in the company early next year.

Consumer credit in the U.S. rose during October, mainly boosted by a rise in student loans, a report by the Federal Reserve said on Tuesday.