Wall Street appears to be almost universally bullish about U.S. stocks for 2011.

Top Ten Predictions for U.S. Economy/Markets in 2011. These predictions come from Michael Yoshikami, president and chief investment strategist of YCMNET Advisors Inc. in Walnut Creek, Cal.

U.S. Treasuries debt prices should stay firm into year-end, following a strong seven-year note auction on Wednesday, as investors square books ahead of year-end and prepare for Federal Reserve purchases next week.

Stocks finished narrowly mixed in very light trading as a monstrous snow storm on the East Coast likely kept many traders home and a rate hike over the weekend by China dampened some investor sentiment.

Bailed-out insurer American International Group

took another step toward winding down its U.S. government support on Monday by securing $4.3 billion of bank credit lines, and company shares surged.Shares of American International Group Inc. (NYSE: AIG) are soundly higher this morning after the company said it entered bank credit facilities totaling $3-billion.

By keeping interest rates at all-time low levels, the U.S. faces the potential for a second major financial crisis, cautioned David Einhorn, the hedge fund manager.

Personal income and expenditure in the U.S. rose for the fifth month during November, according to a report by the U.S. Commerce Department, indicating that the average consumer is growing more confident about the economic recovery and their financial situation.

The nomination of Nobel prize-winning economist Peter Diamond to the Federal Reserve's Board was scuttled on Wednesday when the Senate failed to vote on it before adjourning for the year.

When the return on savings is less than the rate of inflation it doesn't matter that gold doesn't provide you with an income. Tightly supplied and indestructible, it offers a natural and obvious alternative to cash. Inflation expectations are rising as 2011 begins.

This is the best time in decades to buy U.S. stocks, according to Elaine Garzarelli, the analyst who became famous by correctly predicting the stock market crash of October 1987.

Existing home sales in the U.S. picked up again in November, after a surprising drop during October, according to a report by the National Association of Realtors.

A senior bullion logistics executive in Switzerland yesterday told BullionVault that shipments of Gold Bullion to China are running much higher – and have begun much earlier – to meet consumer demand for the Chinese New Year, which will start on 3rd Feb. 2011.

Contrary to the prevailing view, the U.S. economy will gain growth momentum in the year ahead, while GDP will grow stronger in Europe and Japan, research firm IHS Global Insight has said in its forecast for 2011.

Economic evidence today suggests that we don't need QE2, said Nicholas Sargen, chief investment officer at Fort Washington Advisors.

Stocks finished essentially flat in listless pre-holiday trading amidst low volume and a dearth of economic data.

Stifel Nicolaus analyst Chris Brendler downgraded American Express because their credit card businses will lose market share to debit cards.

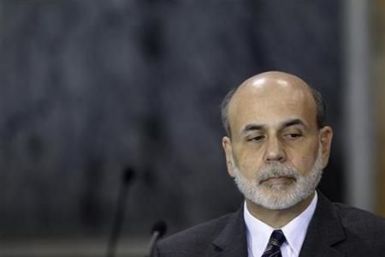

Ben Bernanke and his friends on the Federal Reserve have a PR machine to help sell their lies. Let's assess whether Ben and his Federal Reserve have helped or hurt the average American.

The stock market is up slightly as Chesapeake Energy (NYSE:CHK) jumped 8.41 percent and financial stocks rose broadly. However enthusiasm was tempered by the downgrade of American Express (NYSE:AXP).

Shares of American Express Co. (NYSE: AXP) are tumbling after an analyst at Stifel Nicolaus downgraded the companies because of potential negative impact of pending government regulations.

South Korea announced on Sunday it will start charging a levy on banks' foreign exchange borrowings, a measure aimed at limiting the chances of capital exiting the economy at a time when military tensions with the North are escalating.

The Federal Reserve's $600 billion bond buying program has been at least modestly successful so far, St Louis Fed President James Bullard told the CNBC TV business channel on Monday.