Gold held close to the previous session's near three-week high in Europe on Wednesday, supported by an increased focus on inflation after China's second interest rate hike in six weeks.

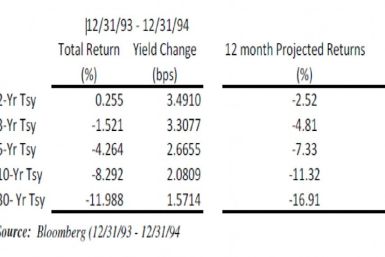

While 1994 was dubbed as the worst year for fixed income investors, we believe that the next twelve months could be even worse

RBC Capital Markets said banks with strongest capital and increased profitability are expected to get green light on dividends. The Federal Reserve is expected to approve dividend increases.

China used its regulatory powers to scour the books of Citibank Shanghai in a hostile and extraordinarily intrusive 2007 audit that appeared primarily aimed at controlling Citi's growth and uncovering its secrets to success, the bank's top China executive at the time told U.S. officials.

Two top Federal Reserve officials said on Tuesday they expect the central bank's $600 billion bond purchase program to run its full course, while a third said the central bank should seriously consider scaling it back.

U.S. inflation is still below the central bank's comfort levels and price rises for individual goods or services does not signal broader price pressures are around the corner, a top Federal Reserve policymaker said on Tuesday.

Three critics of the Federal Reserve are set to testify before Congress on Wednesday in a hearing chaired by Rep. Ron Paul, R-TX, that will focus on the effect of the Federal Reserve's policies on job creation and the unemployment rate.

The Federal Reserve should seriously consider pulling back on its $600 billion stimulus program given stronger growth and a brighter jobs picture, Richmond Fed President Jeffrey Lacker said on Tuesday.

The Federal Reserve should seriously consider pulling back on its $600 billion stimulus program given stronger growth and a brighter jobs picture, Richmond Fed President Jeffrey Lacker said on Tuesday.

Credit card usage in the United States rose in December last year for the first time in more than two years, indicating that consumers are becoming more confident on the economic conditions in the country.

This is a world obsessed with demand...[and] many central banks' policy settings are very, very loose...making for serious inflationary pressures, UBS said. The outlook for food prices is that they could rise exponentially from here if we were to see another shock. There's no buffer right now.

China raised interest rates for the third time since the height of the financial crisis in response to accelerating consumer and asset inflation. The inflation rate and the interest rate hikes in the country are stages of a normal economic cycle, although it's happening with an international twist.

Gold prices inched up on Monday, underpinned by inflation concerns, but a more optimistic economic outlook and worries about interest rate hikes kept bullion from rising further.

Gold held near $1,350 an ounce on Monday after the metal's first weekly rise this year supported investor confidence in the metal, though a more optimistic view of the global economic outlook is continuing to weigh on prices.

China maintains yuan's peg to the dollar by continually purchasing dollars in the open market, which means that China has to buy more ad more dollars as the U.S. currency gets weaker. And here is the role of the U.S. Federal Reserve in exacerbating Beijing's concerns.

Bank of America Corp has agreed to pay $410 million to settle lawsuits accusing it of charging customers with excessive overdraft fees, court documents show.

The pace of economic recovery has reached escape velocity from the worst recession in decades, though the nation may not return to full employment until 2014, a top Federal Reserve researcher said on Friday.

Tighter budgets at the U.S. Securities and Exchange Commission could mean killing vital technology upgrades needed to catch swindlers, the agency's chief said on Friday in a blunt appeal for more funding.

U.S. employment rose far less than expected in January, partly the result of severe snow storms that slammed large parts of the nation, but the unemployment rate fell to its lowest level since April 2009.

Federal Reserve Chairman Ben Bernanke on Thursday issued a stern warning to Republican lawmakers that delays in raising the United States' $14.3 trillion debt limit could have catastrophic consequences.

Federal Reserve Chairman Ben Bernanke on Thursday issued a stern warning to Republican lawmakers that delays in raising the United States' $14.3 trillion debt limit could have catastrophic consequences.

Experts can argue all they want about the causality relationship between food inflation and QE2. What cannot be denied, however, is the correlation.