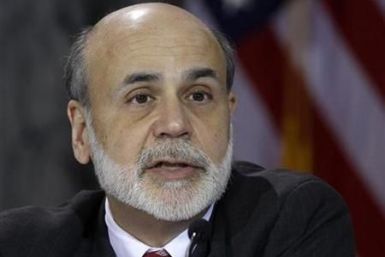

“We have seen increased evidence that a self-sustaining recovery in consumer and business spending may be taking hold,” said Federal Reserve Chairman Ben Bernanke in a testimony to Congress.

Spot gold rose to a session peak at $1,421.35 an ounce and was up 0.6 percent at $1,419.66 an ounce by 1240 GMT. It rose 6 percent in February, its largest monthly rise since August, when the U.S. Federal Reserve first indicated that it would continue the massive money printing by monetizing government bonds.

US stocks advanced in early trade on Tuesday, the first trading day of March, after markets recorded third consecutive monthly gains in February.

Federal Reserve Chairman Ben Bernanke will likely remain skeptical about the strength of the economic recovery in testimony on Tuesday, despite recent data pointing to improvement, signaling the central bank is unlikely to cut short its $600 billion stimulus plan.

Gold was little changed near $1,410 an ounce on Monday but notched its biggest monthly gain since August as chaos in Libya and rising tensions across the Middle East prompted investors to buy the metal as a safe haven. The US dollar lost its status and is at November lows.

U.S. stocks got a boost from some bullish comments by uber-investor Warren Buffett over the weekend and a number of M&A deals. The stock market rose in February, marking the third consecutive month of equity price gains.

South Africa's government bond curve steepened again on Monday with the yield spread between shorter and longer-dated debt hitting a record high as dealers positioned ahead of a debt auction on Tuesday.

A key Federal Reserve official said on Monday the economy can grow for a while before inflation pressures emerge and that policymakers should be wary of withdrawing their support for the economy too soon.

Despite the fact that volatility has increased since the start of the Egyptian crisis on January 25th, true risk aversion seems to have been well contained.

Homeownership as an investment is no longer the rock-solid foundation for the American Dream it once was, according to a survey released on Monday by the firm the government created in the 1930s to promote homeownership.

US stocks opened higher in early trade on Monday, with S&P 500 Index gaining 7.54 points, or 0.57 percent, to trade at 1,326.97 at 09:55 a.m. EST. The Dow Jones Industrial Average is up 76.82 points, or 0.63 percent, to trade at 12,207.27. The Nasdaq Composite Index rose 0.49 percent to trade at 2,795.40.

Despite a rise in inflation expectations caused by a flurry of positive economic data, the U.S. Federal Reserve may still not decide to tighten rates any time soon, according to an analyst.

Oil price gains to date do not pose a risk to the U.S. economy but they could prove nettlesome if they jump a lot higher or create an inflationary psychology, Richmond Federal Reserve Bank President Jeffrey Lacker said on Friday.

The inflation debate is raging in the UK among policy makers. Meanwhile, the only inflation hawk and dissenting voter on the Federal Open Market Committee (FOMC), Thomas Hoenig, is no longer a voting member this year.

A senior U.S. Federal Reserve official said on Thursday he thinks it is time to consider tapering off or scaling back a $600 billion bond-buying program because of an improved economic outlook.

U.S. regulators' efforts to settle with banks over improper mortgage foreclosures are being hampered by infighting among the groups involved in the talks, and a settlement may take a while, according to sources familiar with the matter.

Wall Street's financial giants continue to pose major risks to the U.S. economy, and must be broken up to avoid another meltdown, Kansas City Federal Reserve Bank President Thomas Hoenig said on Wednesday.

King Abdullah of Saudi Arabia - jointly the world's biggest oil producer alongside Russia, and so far immune to the civil unrest sweeping North Africa and the Middle East - returned from hospital treatment abroad to announce a near US$38 billion package of new housing projects, a 15% pay-rise across the board, and the kingdom's first-ever unemployment insurance.

Althea Norwood Roberts gives employers three months to turn her temporary job into a permanent one. Then she looks elsewhere. That's as long as a company needs to see if she's a good fit, the 35-year old single mother from California believes.

US stocks rose modestly higher on Friday, with S&P 500 Index up 2.52 points, or 0.19 percent, to trade at 1,342.98 at 12:00 p.m. EST. The Dow Jones Industrial Average is up 42.16 points, or 0.34 percent, to trade at 12,360.30. The Nasdaq Composite Index rose 0.23 percent to trade at 2,837.98.

China rejected plans to use real exchange rates and currency reserves to measures global economic imbalances, casting doubt on the ability of Group of 20 major economic powers to reach agreement at a meeting on Friday.

US stocks were mixed on Friday, with S&P 500 Index edging down 0.27 points, or 0.02 percent, to trade at 1,340.21 at 09:50 a.m. EST. The Dow Jones Industrial Average is up 14.04 points, or 0.11 percent, to trade at 12,332.18. The Nasdaq Composite Index rose 0.07 percent to trade at 2,833.52.