Mystery solved? For the first time in months, the Labor Department's job market assessment matches up with private surveys showing a pick-up in employment that is finally fast enough to put a substantial dent in the unemployment rate.

The U.S. Federal Reserve is right to carry on with its cheap money policy to fight high unemployment, but policymakers must stay on guard for signs of inflation, two top Fed officials said on Thursday. Atlanta Fed President Dennis Lockhart, speaking in Tallahassee, Fla., said the Fed should stay vigilant for any rise in inflation

The U.S. Federal Reserve's balance sheet expanded to a record size in the latest week, as the central bank continued to purchase bonds, Fed data released on Thursday showed.

The Federal Reserve Bank should continue to flood the economy with cheap money to fight high unemployment, but policymakers must stay on watch for signs of inflation, two top Fed officials said on Thursday.

The U.S. Federal Reserve Bank should complete its $600 billion bond-buying program, but should only extend it if inflation continues to fall, a top Fed official said on Thursday.

The number of Americans filing new claims for jobless aid hit the lowest level in more than 2-1/2 years last week and service sector hiring picked up in February, signs the labor market recovery was quickening. Another report on Thursday confirmed business productivity picked up a bit in the fourth quarter

The European Central Bank (ECB) held the benchmark rate at a record low of 1 percent for the 23rd consecutive month.

Futures on major U.S. indices point to a higher opening on Thursday ahead of economic data including key weekly jobless claims and non-farm productivity.

Futures on major U.S. indices point to a higher opening on Thursday ahead of economic data including key weekly jobless claims and non-farm productivity.

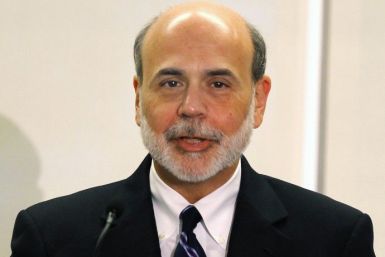

State and municipal government fiscal conditions that have been battered by the economic downturn will get some relief as growth picks up, but a full recovery will be slow in coming, Federal Reserve Chairman Ben Bernanke said on Wednesday.

Political unrest in the Middle East and North Africa adds a dose of uncertainty to an already-fragile U.S. economic recovery, Atlanta Federal Reserve President Dennis Lockhart said on Wednesday.

U.S. stocks edged up higher on some positive jobs data and reassurance from the Federal Reserve that the economy is recovering. However, any equity gains were capped by fears over the continued unrest in Libya and rising crude oil prices.

Bill Gross of PIMCO is concerned for the US government. To him, the big question is who will buy US Treasuries (i.e. lend to the US government) once the Federal Reserve stops QE2.

Economic activity kept slowly gaining strength as 2011 opened and manufacturers and retailers were having some success in pushing their prices up, the Federal Reserve said on Wednesday.

The tremendous rally in gold is a reflection of the poor job the Federal Reserve is doing and the market’s lack of confidence in the central bank and the US, said David Malpass, president of Encima Global, on Bloomberg TV.

U.S. stocks edged up higher on some positive jobs data and reassurance from the Federal Reserve that the economy is recovering.

Gold touched a record high above $1,440 an ounce on Wednesday, as a bullish confluence of political unrest in Libya, surging oil prices and easy monetary policies spurred safe haven buying.

March 2, 1011. Prepared at the Federal Reserve Bank of Atlanta and based on information collected on or before February 18, 2011.

“When inflation gets started, you don't particularly notice it,” said billionaire investor Warren Buffett on CNBC. “It's like a guy jumping out of a 50-story building. The first 45 stories he doesn't really notice a lot of changes in his circumstances. But eventually, [he hits] the ground.

Federal Reserve Chairman Ben Bernanke said on Wednesday a Republican spending cut plan would not cause a big dent to U.S. economic growth, but could cost around 200,000 jobs.

Futures on major U.S. indices point to modestly lower opening on Wednesday as investors eye economic data including ADP national employment report.

China may have more potential than ever to influence U.S. debt prices after data showed the country owns more than a $1 trillion in Treasuries, almost a third more than previously thought.