Morgan Stanley said fourth-quarter shareholder profit surged 60 percent as rising fees from wealth management offset the weak fixed-income trading results that have marred its competitors earnings.

Goldman Sachs earned less money in fourth quarter 2010, led by declines in their ultra-profitable market making business.

The companies that reported earnings before the markets open on Wednesday are: Goldman Sachs, Wells Fargo, U.S. Bancorp, State Street, Northern Trust, Bank of New York Mellon and Hudson City Bancorp.

Safaricom, Kenya's largest company by market capitalisation, dragged down the main

index after losing more than 4.0 percent on Friday.

At least 10 asset managers are preparing to launch yuan-denominated funds in Hong Kong to tap robust overseas demand for yuan assets amid expectations of faster yuan appreciation and broader investment channels, two people with direct knowledge of the matter said.

2011 is shaping up as a race to the bottom for currency values, writes Harvard professor Kenneth Rogoff in today's Financial Times. No wonder gold has been so attractive.

Text of Goldman Sachs 8-K filing showing 2010 earnings under new disclosure standards

The consolidation in the banking sector will continue, according to two industry executives whose institutions are in a position (and open to) buying smaller banks.

Robert W. Baird & Co. CEO Paul Purcell speaks to IBTimes about his firm's performance during the financial crisis, navigating the financial services industry after the crisis, and the advantages of being a privately-held financial services firm.

Many observers believe the bond bull has run out of steam, although a 'pop' in the bond bubble is probably unlikely.

It's going to be tougher to make money 2011. I expect the government to strike back. I don't think they're going to let commodity prices continue to soar. I'm very concerned about the repercussions of that on investors.

BlackRock is planning to launch an internal trading platform next year, a move that could put a pressure on the profits of many Wall Street firms.

Dan Fuss speaks to IBTimes about his short-term and long-term outlook for U.S. Treasuries.

Although some progress appears to be being made in the euro zone sovereign debt crisis – including the passage of an austerity budget by the Greek Parliament today and a capital injection into Allied Irish Bank (NYSE: AIB) – the most important member of the euro currency bloc, Germany, is unlikely to foot the total bill that will be required to truly resolve this issue.

James Tyree, CEO of Mesirow Financial, speaks to IBTimes about how his firm is navigating the challenges of the post-crisis financial world.

The Gold Price held near last night's new record highs for US, Euro and Sterling investors in London trade on Tuesday, recording an AM Gold Fix at $1426 per ounce as world stock markets gained more than 1.5%.

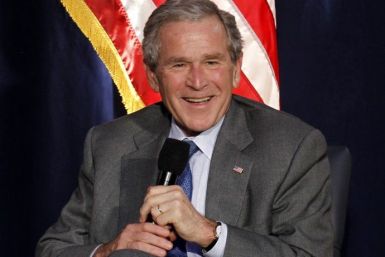

The saga surrounding the extension (or repeal) of George W. Bush’s tax cuts seems to be changing daily, almost hourly. It’s a highly complex and contentious issue that will (perhaps unfortunately) be decided solely by politics.

Retail sales in October picked up pace, and brightened the outlook for year-end shopping as purchases rose 1.2%, the highest in the last seven months.

Women lawyers in America's top law firms have not benefited from structural changes that created nuanced stratifications of lawyers, a survey by the National Association of Women Lawyers and the NAWL Foundation suggests.

To some degree, Japan allowed deflation, or at least they did not choose extremely aggressive policies to fight it. This is largely due to the influence of Japanese constituents who own fixed income, which would devalue in the face of inflation.

Suze Orman speaks to IBTimes about the current economic situation for Americans and gives advice to people with underwater mortgages and seniors living on fixed income.