U.S. money managers sitting on piles of cash are sniffing out opportunities to make a killing on the political circus in Washington over raising the nation's debt ceiling.

Not for the first time, asset managers may be playing a high-risk game as they face the threat of a U.S. debt default without concrete contingency plans.

Policymakers worldwide oscillated between hope and confidence on Monday that U.S. lawmakers will break a debt impasse that threatens to trigger a default and up-end global financial markets.

French President Nicolas Sarkozy's key role in calming the euro zone crisis helps to take some of the heat off his own country's simmering debt troubles in the run-up to a presidential election.

A sharply divided Congress pursued rival budget plans on Monday that appeared unlikely to win broad support, pushing the United States closer to a ratings downgrade and debt default that would send shockwaves through global markets.

Wall Street banks are reported to post poor second quarter results this week, accounting for nearly a 20 percent drop in sales and trading revenues and prompting another round of layoffs, according to the New York Times.

Fears are spiraling that Italy may need a bailout as the yield on the country’s government bonds have surged to 5.4 percent.

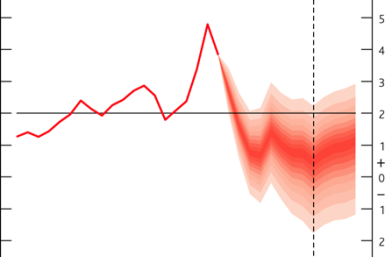

Since June 15, there has been a significant rise in Treasury yields. Below we present several reasons for the spike and why we think that interest rates will continue to move higher.

Yesterday, a highly valued client of ours posed this question to us: ”Do you think that we are headed towards a depression?” It is not clear to me what event triggered the question, but my answer was a resounding “No”.

David Levy, chairman of the Jerome Levy Forecasting Center, believes in the future of America. He thinks the economy will not only fully recover but also improve its position on the global stage from its current slump.

The most powerful pro-business voice in Brazil's government resigned on Tuesday following a scandal over his sudden enrichment, prompting worries on Wall Street that his departure could herald a leftward drift in economic policy.

On May 22, the Federal Reserve Bank of New York added 32 new money market funds in addition to the existing set one of Primary Dealer counterparties.

Gold sat tight as Silver Prices sank once more in London trade on Wednesday morning, holding above last night's 2-session low of $1528 per ounce while silver dropped to new 3-week lows, flirting with the technical definition of bear market.

This week’s Federal Open Market Committee (FOMC) meeting should not interrupt the recent positive performance of the US financial markets.

Silver Prices extended their Dollar gains to 7.7% for this week alone, also reaching new multi-decade and all-time highs vs. the world's other major currencies.

It is our contention that if the monthly private sector job growth shows a gain of 200,000 jobs or more, then it will be very difficult for the financial markets not to have a strong response to the collective employment data.

The text of Wisconsin Governor Scott Walker’s speech regarding the budget:

The chances of Portugal accepting a bailout has increased as hopes of reining in the borrowing costs of peripheral European governments have faded.

China may have more potential than ever to influence U.S. debt prices after data showed the country owns more than a $1 trillion in Treasuries, almost a third more than previously thought.

You can't really blame financial hacks for getting things so wrong, so often. Because every financial decision you now make is a speculation on interest rates. And so pretty much every story a financial journalist might choose to write must start and end with the same speculation, built on the inaction of each monthly central-bank vote.

Deutsche Boerse AG's planned takeover of NYSE Euronext faces intense scrutiny from German regulators and European antitrust authorities, potentially imperiling the blockbuster exchange tie-up.

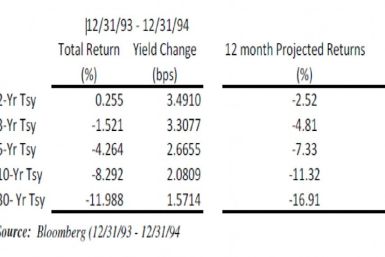

While 1994 was dubbed as the worst year for fixed income investors, we believe that the next twelve months could be even worse