The EU is looking into the possibility of making Libor and Euribor rate-rigging -- the deliberate manipulation of interest rates that set the benchmark for over $500 trillion in financial contracts - a criminal offense.

The future of Fannie Mae and Freddie Mac, the two government-controlled entities that guarantee around 60 percent of the U.S. mortgage market, remains uncertain, but their federal regulator is requesting a plan to wind them down and sell their assets.

Although the U.S. home construction industry continues to lag behind the broader job market, improvements in housing are expected to create jobs and boost construction this year, mortgage financier Freddie Mac said in a new report, Housing: Getting Back To Work.

The pace of bankruptcy filings in the U.S. is slowing down to pre-recession levels, but don?t cheer just yet ?because hundreds of thousands of Americans might have been too broke to file for bankruptcy.

U.S. 30-year fixed-rate mortgages fell to a record low of 3.62 percent, its 10th such weekly record low in the last 11 weeks, following weak economic data, mortgage financier Freddie Mac said Thursday.

U.S. 30-year fixed-rate mortgages fell to a new record low of 3.66 percent following weak economic indicators, mortgage financier Freddie Mac said Thursday.

The prolonged crisis in the euro zone, coupled with signs that the U.S. economic recovery is faltering, have led to speculation that the Federal Reserve will provide more monetary stimulus, most likely through extending its Operation Twist program, at the June two-day Federal Open Market Committee meeting, which concludes on Wednesday June 20.

The dissolution of Fannie Mae and Freddie Mac, the two largest U.S. mortgage guarantors, would have only a minimal impact on home ownership level, according to a new report that downplays the link between low interest rates and increased ownership.

Four years after the 2008 financial crisis began gathering steam, the government has collected another piece of the remaining billions in bailout money that it's owed.

U.S. 30-year fixed mortgage rates increased to 3.71 percent, reversing six weeks of declines after modestly positive economic data, mortgage financier Freddie Mac said Thursday.

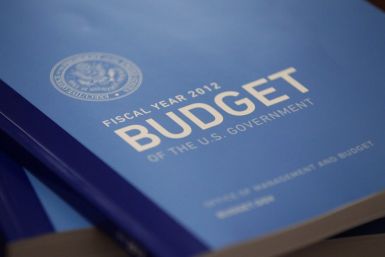

The IOU that is being laid on the doorsteps of U.S. taxpayers in the form of the national debt is far greater than most Americans realize. That's because the federal government does not report the true size of the national debt -- now nearly $80 trillion.

Fannie Mae, the federally controlled mortgage giant, said Tuesday it is appouinting its general counsel, Timothy Mayopoulos, as its new president and CEO.

Home prices are stagnant, crude oil is tumbling and copper has fallen to a seven-month low. Inflation is not the problem. What is the problem is inflation's evil twin, deflation.

U.S. mortgage rates dropped even lower in the week ending May 31, with the 30-year rate falling to 3.75 percent, mortgage financier Freddie Mac said Thursday.

Time to stop dropping the presumptive and the likely qualifiers: It is all but certain that after Texans finish voting in Tuesday's Republican presidential primary, Mitt Romney will have secured the 1,144 delegates he needs to win the nomination.

French and German consumer confidence showed unexpected strength, reports showed Friday. While the market is cheering about the good news, some economists view this as a warning sign of a euro zone crisis fatigue - something that is as dangerous, if not more so than the crisis itself.

U.S. mortgages rates have dropped to record lows for four consecutive weeks, but that doesn't mean more homes will be sold. In fact, at least one housing expert argues that extremely low rates are causing banks to be even more stringent with underwriting approvals, turning away more prospective buyers and hurting the national housing market.

U.S. 30-year fixed mortgage rates dropped to 3.78 percent in the week ending May 24, down slightly from 3.79 percent in the previous week, mortgage financier Freddie Mac said Thursday.

U.S. 30-year fixed-rate mortgages hit a new record low for the third straight week as concerns over the euro zone weighed on the economy, mortgage financier Freddie Mac said Thursday.

Freddie Mac (OTC: FMCC), the second-largest U.S. mortgage guarantor, said Thursday it was appointing Donald Layton, the former head of E*Trade as its CEO.

New Labor Department data suggests a strong start to jobs growth in January may not get wiped out by negative growth heading into the third quarter.

U.S. 30-year fixed-rate mortgage rates hit a new record low in the week ending May 10, following lower Treasury bond yields and weaker economic data in April, mortgage financier Freddie Mac said Thursday.