U.S. mortgage applications increased 4.1 percent on a seasonally adjusted basis in the week ending Dec. 9, led by an increase in refinances, according to the Mortgage Bankers Association.

The city of Chicago said on Tuesday that it would vigorously defend a lawsuit filed by the Federal Housing Finance Agency (FHFA), which challenges an ordinance regulating the maintenance of vacant properties.

Republicans raised concerns on Tuesday over the Obama administration's nominee to head the Federal Housing Administration (FHA), as a possible bailout for the agency looms.

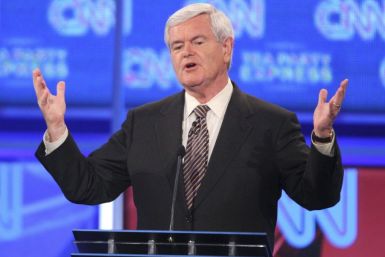

Savage isn't shy about saying why Gingrich can't beat Obama, either. On his blog, he shows Gingrich ads with Nancy Pelosi, the right-wing's antithesis, mentions Gingrich's past infidelity, and notes that when Gingrich is on television he ca off badly compared to Obama and looks like nothing more than what he is: a fat, old, white man.

Radio host Michael Savage has plans to offer Newt Gingrich $1 million to drop out of the presidential race for the sake of the nation.

The Federal Housing Finance Agency (FHFA), regulator of Fannie Mae and Freddie Mac, on Monday sued the city of Chicago over its new vacant buildings ordinance.

Republican presidential candidate Mitt Romney called on fellow candidate Newt Gingrich on Monday to return $1.6 million in fees from consulting work for Freddie Mac.

Sheila Bair, former chairwoman of the Federal Deposit Insurance Corp. (FDIC), is said to be the leading candidate to monitor banks during a nationwide foreclosure settlement.

Newt Gingrich, the Republican front runner for 2012 U.S. presidential election, is indeed emerging as a colorful personality. After initial campaign setbacks he faced due to his personal history, Gingrich surged to the top of the contenders’ list. But his emergence as a serious contender also raises interesting questions.

Surging front-runner Newt Gingrich fought off heavy attacks in a presidential debate in Iowa on Saturday from Republican rivals who portrayed him as a Washington insider and questioned his judgment.

Surging front-runner Newt Gingrich came under heavy fire in a presidential debate in Iowa on Saturday from Republican rivals who portrayed him as a Washington insider who profited from his contacts at taxpayer expense.

U.S. Sen. Johnny Isakson, R-Ga., introduced on Thursday a bill to wind down Fannie Mae and Freddie Mac and create a transitional mortgage program to be sold to the private sector after 10 years.

The 30-year fixed-rate mortgage rate dropped to 3.99 percent in the week ending Dec. 8 from four percent in the previous week, according to Freddie Mac.

Fannie Mae and Freddie Mac have prevented almost 2 million foreclosures since the enterprises were taken under federal conservatorship in 2008, according to a report by the Federal Housing Finance Agency (FHFA).

U.S. mortgage applications increased by 12.8 percent in the week ending Dec. 2, compared to the previous week, according to the Mortgage Bankers Association (MBA).

For most of her campaign, Michele Bachmann has made more headlines for her gaffes than for her platform, and her popularity has fallen as a result. But moving past the YouTube clips and headlines, what are the Minnesota congresswoman's political positions?

Occupy Homes, an offshoot of Occupy Wall Street, will protest in foreclosed and vacant properties in around 25 U.S. cities on Tuesday's Day of Action, promoting what organizers call the basic human right of housing.

The Federal Housing Administration (FHA)'s mortgage insurance fund is threatened by declining home prices and could require a taxpayer bailout, Congress members said at a hearing on Thursday, echoing an earlier report.

Average rates for 30-year fixed-rate U.S. mortgages increased slightly to 4 percent from 3.98 percent in the week ending Dec. 1, according to Freddie Mac.

A new ad from the Ron Paul campaign points out Gingrich's plentiful inconsistencies.

U.S. mortgage applications decreased on a seasonally adjusted basis by 11.7 percent in the week ending Nov. 25, according to the Mortgage Bankers Association (MBA).

Wells Fargo Securities said the California housing market continues to struggle and is not yet ready to bolster California's economic rebound.