HSBC Holdings, Europe's biggest bank, said paying rising wages in Brazil, China and other emerging market is the price of avoiding the slowdown being felt by most of its rivals as it posted the largest 2011 profit by a western bank.

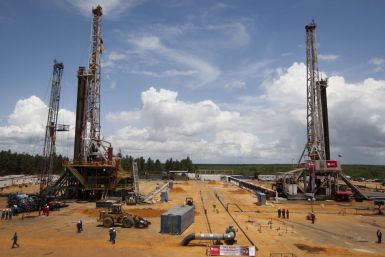

The prices of gasoline and other energy commodities are on the rise -- with further increases just over the horizon -- and it appears that everyone is taking notice.

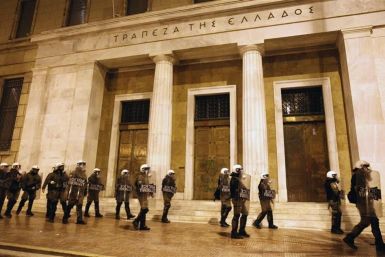

Greece formally launched a bond swap offer to private holders of its bonds on Friday, setting in motion the largest-ever sovereign debt restructuring in the hope of getting its messy finances back on track.

International bankers called on Group of 20 finance leaders on Friday to step up their efforts to promote economic growth, warning that spillover risks from the euro zone remain.

Finance ministers and central bank chiefs from the Group of 20 countries will meet this weekend in Mexico City to tackle the euro zone's debt crisis and the prospect of replenishing the International Monetary Fund.

With citizens of debt-burdened European countries growing more disillusioned over spending cuts and other austerity measures, it may not be long before hard-line parties opposed to such policies begin to siphon support.

Venezuela's economy grew last year, after two straight years of GDP contraction.

The euro zone area will fall back into recession this year due to the contracting economies of Greece, Italy and Spain, the administrative arm of the European Union said Thursday, abandoning its earlier prediction that recession will be avoided.

Indian gold imports in 2012 could fall by a fifth for the first time in three years to 770 tonnes as investors chase better accruals from equity markets and other financial instruments, possibly ceding the position of top consumer to China.

The business sentiment survey in Germany Thursday strengthened expectations that Europe's largest economy is on its way to avoid a contraction in the first quarter this year, easing concerns over country slipping back into recession.

The loan comes just in time for Greece, which has to repay a maturing loan by March 20 to avoid bankruptcy.

Tuesday's long-awaited second rescue package for Greece steadied the euro and removed the immediate threat of a disorderly bond default, but markets remained cautious in early morning trading, fearful of what lies ahead for the stricken country.

European stock markets mixed in early trade Tuesday after eurozone finance ministers sealed a deal on second rescue package for debt-laden Greece.

Euro zone finance ministers reached an agreement to hand Greece a bailout package worth 130 billion euros ($171 billion) , to help the country avoid a default.

In a much anticipated decision, EU finance ministers have reached an agreement on the second bailout of 130 billion euros.

Euro zone finance ministers struck a deal early on Tuesday for a second bailout program for Greece that will involve financing of 130 billion euros and aims to cut Greece's debts to 121 percent of GDP by 2020, EU officials said.

Euro zone finance ministers inched toward approving a second bailout for debt-laden Greece Monday night that would resolve Athens' immediate repayment needs but seems unlikely to revive the nation's shattered economy.

Greece will need additional relief if it is to cut its debts to 120 percent of GDP by 2020 and if it doesn't follow through on structural reforms and other measures, its debt could hit 160 percent by 2020, a confidential analysis conducted by the IMF, European Central Bank and European Commission shows.

There are some major concerns regarding the rescue package and the efficacy of the Athens government in imposing much-needed austerity.

Japan reported a record-high balance of trade deficit in January as last year's tsunami combined with floods in Thailand, the Eurozone's sovereign debt crisis, a slowing Chinese market and a soaring yen to leave the world's third-largest economy with its first trade deficit since the last century.

Pakistan's Reko Diq, an untapped copper and gold mine of fabulous potential, was meant to be the biggest foreign investment in the country's mining sector, but it's beginning to look more like fool's gold to the companies involved.

For some observers, Greece can seem like a small problem in a distant land, incapable of affecting U.S. investors. But in the financial crisis era, that is most certainly not the case.