Eurozone finance ministers aim to agree a second financing package for Greece on Monday, a decision they hope will boost market confidence in euro zone public finances and help contain the two-year-old sovereign debt crisis.

U.S. 30-year fixed-rate mortgage rates dropped to another record low of 3.87 percent in the week ending Feb. 2, down from 3.98 percent in the previous week, according to Freddie Mac.

Belgium has become the first eurozone member, not subject to a bailout programme, to formally fall into recession in the second half of last year, according to data released by the country's central bank.

Government spending for Medicare, Medicaid and other health care programs will more than double over the next decade to $1.8 trillion, or 7.3 percent of the country's total economic output, congressional researchers said.

Greece's prime minister is seeking backing from the country's political leaders for more austerity measures, with the International Monetary Fund warning that long-term commitment to reforms is key to securing a new bailout.

The federal budget deficit will dip to the still substantial sum of $1.1 trillion in 2012 as the economy continues to grow slowly, according to a projection by the Congressional Budget Office (CBO).

Spain has the highest jobless rate in the euro zone (22.9 percent), while Austria has the lowest (4.1 percent).

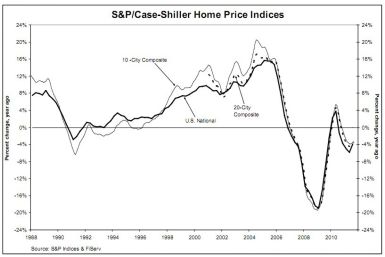

U.S. home prices fell more sharply in November, compared to the previous month, according to S&P/Case-Shiller Home Price Indices data released on Tuesday.

The BSE Sensex rose more than 1 percent on Tuesday morning, led by gains in index heavyweights Reliance Industries (RELI.NS) and ICICI Bank (ICBK.NS), and were poised for their best month in at least ten.

Greece's Prime Minister Lucas Papademos held talks on restructuring Greek debt with senior officials from the European Central Bank and the European Union after an EU summit on Monday, officials said.

Belgium is compelled by the EU to slash its deficit to below 3 percent of GDP from 4.2 percent in 2011.

U.S. home prices are expected to continue to fall in S&P/Case-Shiller Housing Index data through November 2011, to be released on Tuesday, Jan. 31.

In a remarkable statement to CNBC this morning, one of the most important dissenting voices within the Federal Reserve said the U.S. central bank's assesment of the economy is too pessimistic, and will likely change as the year progresses. Even more notably, he stated the Fed will likely begin raising benchmark interbank lending rates before mid-2013 -- a direct contradiction on a statement by the Fed last Wednesday.

France has cut its economic growth forecast for 2012 to 0.5 percent from 1 percent, Prime Minister Francois Fillon said Monday.

Japan’s population may shrink by one-third over the next fifty years.

India and China are following dramatically different trajectories in their paths to prosperity.

EU leaders will sign off on a permanent rescue fund for the euro zone at a summit on Monday and are expected to agree on a balanced budget rule in national legislation, with unresolved problems in Greece casting a shadow on the discussions.

Delivery trucks wear out, computers break down, software becomes outdated -- and finally businesses have to start investing in new equipment. Companies that want to remain competitive have to start spending again as an economy slowly recovers.

Growth in the U.S. gross domestic product during the fourth quarter of last year was estimated at 2.8 percent -- slightly below the consensus expectation of 3.0 percent, but still the best reading in 2011. However, most of the growth came from inventory rebuilding, which can support GDP growth only temporarily.

European shares ended down on Friday as disappointing U.S. economic data prompted investors to cash in January's gains, dragging the blue-chip index to its first weekly loss since mid-December.

Gold prices posted a modest gain Friday, capping a three-day rally as well as a week in which the yellow metal jumped 4.15 percent.

U.S. stocks fell on Friday after data showed the U.S. economy grew less than expected in the fourth quarter, while weak earnings from Ford and continued caution over Europe's debt crisis also weighed on the market.