Gold prices steadied near $1,640 an ounce in Europe on Tuesday as a softer tone to the dollar arrested the previous session's slide, but traders largely stuck to the sidelines ahead of a key monetary policy meeting of the U.S. Federal Reserve.

Gold prices slid below $1,630 an ounce on Monday as concerns that the euro zone debt crisis could ensnare higher-rated countries hurt the single currency, though moves were muted ahead of this week's Federal Reserve meeting.

Gold stayed nearly flat in thin trade on Friday, on track to log declines for two of the past three weeks as investors took to the sidelines ahead of a key U.S. option expiration and a Federal Reserve policy meeting next week.

Gold rose above $1,645 an ounce on Friday as a better-than-expected German business sentiment survey lifted the euro versus the dollar, but trading was light as investors awaited further news on the euro zone crisis and U.S. monetary policy.

Gold eased on Thursday as European debt jitters and worries over the U.S. job market extended the metal's losses for a fifth consecutive day.

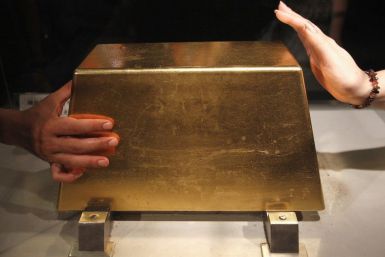

While chances of a third round of U.S. money-printing quantitative easing measures, or QE3, have dimmed, the World Gold Council, or WGC, remains positive on the yellow metal's outlook due to its international appeal and value in hedging against inflation and deflation.

Fresnillo, the world's largest primary silver producer, posted first-quarter output of the metal in line with its expectations and said production of gold was ahead of target, helped by the start-up of a new mine in Mexico.

Gold eased on Wednesday, having fallen for the past three trading days, as the euro came under pressure from continued worries about the euro zone.

Gold prices rose slightly Tuesday on higher crude oil prices and a declining dollar.

The Reserve Bank of India (RBI) has asked banks to reduce their exposure to non-banking financial companies (NBFCs), which have given loans mostly against gold, sending shares of such companies sharply lower.

Canada's Endeavour Silver Corp (EDR.TO) is buying two of AuRico Gold's (AUQ.TO) silver and gold mining interests in Mexico for up to $250 million in cash and stock to expand its footprint in the country.

Gold prices fell in quiet trade on Monday, following crude oil's losses, as worries about Spain's ability to repay its debt and a resurgent euro zone debt crisis extended bullion's loss to a second day.

Gold prices slipped below $1,670 an ounce on Friday, pausing in their biggest one-week rally since late February as the dollar firmed against key currencies, with the euro falling out of favour due to worries over Spain's financial health.

Gold eased for a second consecutive day on Thursday, but was still set for its largest weekly gain in six weeks, thanks to the toll the re-emergence of the euro zone debt crisis has taken on investor risk appetite.

Gold steadied on Tuesday, surrendering earlier gains as a rally sparked by expectations that a sluggish U.S. employment market could fuel further monetary easing ran out of steam in the face of a firming dollar and easing appetite for risk.

Gold prices rose more than 1 percent on Monday, recovering from last week's hefty drop after disappointing U.S. jobs data revived hopes for fresh monetary easing and a spike in Chinese inflation boosted appetite for the metal.

Gold rose on Thursday, as investors covered short positions after a sharp two-day pullback, and a crude oil rally also buoyed the precious metal that sank early this week on disappointment about further U.S. monetary easing.

Gold inched higher on Thursday after falling to a near three-month low the previous day as weaker prices tempted some buyers, but gains were capped by a stronger dollar and fading hopes for a fresh round of monetary stimulus in the United States.

A collapse in gold producers lofty valuations has sparked soul searching about an exodus of restive shareholders, forcing them to tighten operations and boost dividends to lure investors.

Gold prices hit their lowest since early January on Wednesday as comments from the European Central Bank lifted the dollar to three-week highs against the euro, accelerating a fall sparked by declining expectations of more U.S. monetary easing.

Gold held near $1,675 an ounce on Tuesday as investors took to the sidelines ahead of the release of minutes from the Federal Reserve's latest policy meeting, which will be closely watched for clues on the direction of monetary policy.

Gold prices rose above $1,680 an ounce on Monday as the dollar steadied off earlier one-month highs against the euro, with the U.S. unit further paring gains after U.S. construction spending and manufacturing data.