India's bullion traders stayed away from placing fresh orders after a nearly 90 percent hike in gold import duty was announced earlier this week, while China's gold purchases slowed down ahead of the Lunar New Year holiday.

Gold prices could rise to $2,000 an ounce in 2012, according to the predictions of the latest Thomson Reuters GFMS survey and GFMS Ltd's CEO Philip Klapwijk.

The new price average for gold is expected at $1,640 per troy ounce by the end of the first half of 2012, according to Thompson Reuter's GFMS most recent report on the yellow metal.

Toronto's main stock index was slightly lower on Tuesday as losses from gold miners offset the impact of an early surge in commodity prices that were boosted by solid economic data from China and Germany.

Gold prices jumped Tuesday after China reported fourth-quarter gross domestic product grew more than expected.

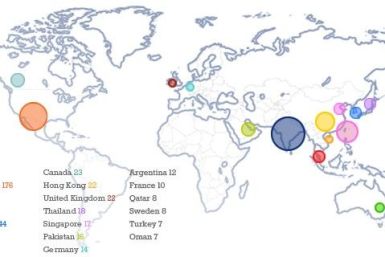

The IBT 1000 List of the fastest-growing public companies in the world -- which debuts today for what its editors hope will be yearly issuance -- is a reflection of the engines driving the world's economic growth.

Gold miners expect the price of the metal to continue climbing in 2012, with most respondents expecting a peak around $2,000 an ounce, according to a survey of gold companies by consultants PwC.

Gold firmed in Europe on Monday, rising back above $1,640 an ounce, as a recovery in stock markets and the euro took some downward pressure off prices, with traders digesting last week's mass downgrade of euro zone countries from Standard & Poor's.

Goldman Sachs said it expected upside in prices of oil, gold and copper this year, citing greater supply risks and stronger fundamentals.

Gold prices struggled to hold recent gains Friday as a successful Italian bond auction buoyed optimism about the direction of the Eurozone's economy.

Gold rose to a one-month high on Thursday, as comments by the president of the European Central Bank on cheap money stabilizing the region's banking system extended the metal's gain to a third consecutive day.

U.S. Gold Corp (UXG.TO) Chief Executive Rob McEwen said he expects global financial worries to push gold prices above $2,000 an ounce this year and even higher in the next few years.

Gold prices, which already this week broke above a key resistance level, barreled on Thursday toward a one-month high.

Canadian stocks ended slightly lower on Wednesday, weighed down by sharply weaker energy issues, as oil prices slid and investors remained cautious about Europe's debt crisis.

Gold prices extended gains into the second day on Wednesday, rising above the closely-watched 200-day moving average. The yellow metal is trading at around its highest level in a month, supported by strong physical demand from India and China.

Gold rose for a second day on Wednesday, hitting its highest in a month, as evidence of strong demand from major consumerChina helped boost the price above a key technical level, and offset the impact of a softer euro.

Gold traders in India, the world's biggest buyer of bullion, stepped up buying for the upcoming wedding season, as gold prices stayed near the week's trough, giving silver a boost.

Strong demand from China and India as well as short covering Wednesday extended a gold price rally that has lifted the yellow metal six percent since the end of last month.

Gold prices rose 1.5 percent near a closely watched level Tuesday to a three-week high as the dollar weakened and stocks rallied.

Gold rose towards $1,640 an ounce on Tuesday and other precious metals rallied, with a rebound in the euro versus the dollar making dollar-priced assets more attractive to holders of other currencies, and after bullion breached a key chart level.

Gold prices closed modestly lower Monday but other precious metals posted gains as bargain hunters moved in to take advantage of discounts on silver, platinum and palladium.

Oil, gold and base metals are Goldman Sachs' top commodity picks this year, with big upside risk in oil due to tight fundamentals and a potential Iranian conflict, the investment bank said on Monday.