This year's heady bout of risk aversion on financial markets has ratcheted up demand for gold, U.S. Treasuries and the Swiss franc to levels that suggest they may no longer be the safe havens they are billed as.

Russia's central bank will offer gold-backed loans for up to 90 days at an interest rate of 7 percent, it said in a statement on Friday, expanding its lending facilities for dealing with any future liquidity crunch in the banking system.

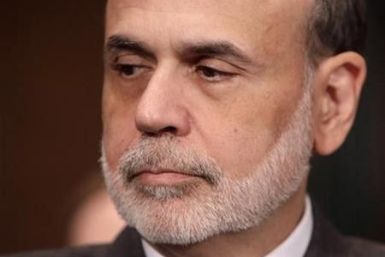

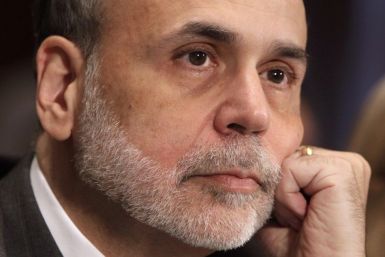

Gold prices arrested this week's slide on Friday to rise nearly 1 percent ahead of a speech from Federal Reserve chairman Ben Bernanke in Jackson Hole, Wyoming, later, which will be closely watched for hints on the outlook for Fed monetary policy.

Spot gold was steady on Friday, but was likely to register its first weekly drop after seven straight weeks of gains as investors awaited a speech by U.S. Federal Reserve Chairman Ben Bernanke later in the day.

This year's heady bout of risk aversion on financial markets has ratcheted up demand for gold, U.S. Treasuries and the Swiss franc to levels that suggest they may no longer be the safe havens they are claimed to be.

Spot gold lost 0.4 percent Friday, on course for its first weekly drop after seven straight weeks of gains, as investors awaited a speech by U.S. Federal Reserve Chairman Ben Bernanke later in the day.

Gold prices fought off an early drop to post modest gains Thursday as investors thought better of the yellow metal's value as a safe haven.

Fed Chairman Ben Bernanke's much-anticipated speech Friday will likely disappoint investors and policy makers hoping for signs the central bank will try to rev up the weak economy, but the speech is likely to relieve gold investors who have booked big profits from that same economic malaise.

Gold rose on Thursday after two days of sharp declines, as tumbling European and U.S. equity markets sparked by talk that Germany might enact a short-sale ban prompted investors to buy gold as a safe haven.

Hong Kong shares were higher by midday Thursday, mainly driven by several Chinese companies that reported forecast-beating interim earnings, magnifying the lift from Wall Street gains on encouraging U.S. economic data.

Gold Fields Ltd., a major gold mining company, warned Thursday that there were several Web sites that use Gold Fields branding and purport to be investment vehicles on behalf of the company.

The price of silver rose Thursday as stocks fell and the price of gold extended its losses for a third day.

The price of gold extended losses Thursday after the Chicago Mercantile Exchange, the world's largest derivatives market, raised margin requirements on gold futures for the second time in a month.

You've got to put your money somewhere, right? Under the mattress doesn't really work as a retirement program. It's lumpy, vulnerable to theft and your kids might find it.

Gold prices tumbled for the past days, falling around 10 percent from its peak reached on Tuesday.

The top pre-market NASDAQ Stock Market gainers are: TiVo, Clean Energy Fuels, F5 Networks, SodaStream International, and Prospect Capital. The top pre-market NASDAQ Stock Market losers are: Sigma Designs, Applied Materials, Infosys Technologies, Vodafone Group, Randgold Resources, and Apple.

The euro inched up against the dollar on Thursday, tracking gains in European shares on speculation the Federal Reserve may signal more economic stimulus measures, but analysts saw the risk of a correction if such expectations are not met.

SPDR Gold Trust said its holdings fell 2.2 pct, in its biggest one-day drop in seven months, as gold futures slid more than $100 on strong U.S. economic data and ahead of a key Federal Reserve meeting.

Commodities trader Glencore International posted a 50 percent rise in headline first-half profit and said it saw opportunities emerging from turbulence in its key markets as commodity demand remains strong.

World stocks edged up on Thursday while gold fell sharply as investors took an optimistic view of how clearly the Federal Reserve will commit to supporting the economy at a gathering this week.

Muammar Gaddafi will try to sell part of Libya's gold reserves to pay for his protection and sow chaos among tribes in the north African country, said his former central bank governor Farhat Bengdara.

For Eriko Ebina, standing outside a downtown Tokyo medical equipment store that has a side business buying gold, the recent surge in prices for the precious metal was just too tempting.