The massive $26 billion mortgage settlement between states and banks is designed to help millions of American homeowners -- but not everyone is eligible.

Forty-nine states and five major banks reached a $26 billion mortgage settlement that will aid about two million homeowners, government officials announced Thursday.

The announcement caps more than a year of chaotic negotiations among state and federal officials, and the banks, who have been accused of using robosigners and unlawful documentation to deal with a flood of foreclosures.

California and New York, two big holdout states in a $25 billion mortgage settlement, are expected to join the deal, smoothing the way for an announcement on Thursday, according to a person familiar with the matter.

California and New York, two key holdout states for a multi-state mortgage settlement, are expected to join the deal, smoothing the way for an announcement expected on Thursday, according to a person familiar with the matter.

Foreign and U.S. banks warned lawmakers on Wednesday that broad application of U.S. swaps rules could undermine U.S. competitiveness abroad, increase the cost of hedging and even provoke brinkmanship among international regulators.

Wall Street has been lashing out against the Volcker rule since it was proposed, but a senior Goldman Sachs executive said on Wednesday the trading restriction might actually help the investment bank's profitability.

As the nation's five largest mortgage lenders edge close to a $25 billion settlement over foreclosure abuses, it's becoming clear that the deal will have little or no impact on their future bottom lines.

A multi-state mortgage settlement in the works for more than a year will likely be pushed back again as dissident U.S. states continue to press specific concerns and ignore a Monday deadline to decide whether they will sign it.

In the weeks leading up to Facebook's $100 billion initial public offering, Mark Zuckerberg reportedly told Goldman Sachs, Morgan Stanley, JPMorgan Chase and the other banks involved in the action to stop leaking information to the media.

California and New York may join a settlement between states and major lenders over foreclosure fraud, potentially boosting the banks' aid to homeowners to $25 billion from $19 billion.

Almost every major global economy showed positive momentum in the manufacturing sector during January, according to data compiled by various economic-research organizations.

The lawsuit accuses banks of creating a registry service that fails to accurately track mortgage ownership and lacks any legal authority to initiate foreclosures.

The top aftermarket NYSE gainers Thursday were: Sony Corp, PerkinElmer, Genworth Financial, Covanta Holding, Neustar, Iamgold Corp, Investment Technology Group, Netsuite and Weyerhaeuser Co.

Stock index futures were little changed on Thursday as investors looked ahead to weekly jobless claims data, one last clue about the state of the labor market before Friday's key non-farm payrolls report.

A proposed settlement to resolve mortgage abuses by top U.S. banks will give states broad authority to punish firms that mistreat borrowers in the future, according to documents seen by Reuters on Wednesday.

JPMorgan Chase & Co has agreed to drop almost all of a $710 million claim against Lehman Brothers Holdings Inc's bankruptcy estate, freeing up more money to be distributed to creditors, Lehman said on Wednesday.

A proposed settlement to resolve mortgage abuses by top U.S. banks will give states broad authority to punish firms that mistreat borrowers in the future, according to documents seen by Reuters on Wednesday.

Facebook's initial public offering is likely to set a new standard for how low investment banks are willing to go on advisory fees to win big business.

A tumultuous 12 months that saw revolutions in the Middle East, a worsening debt crisis in Europe and a tsunami in Japan has set the tone for corporate activity in 2012.

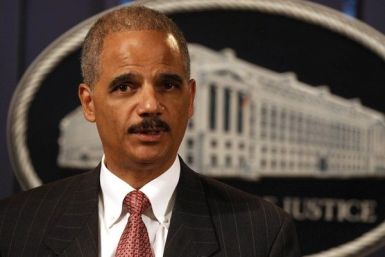

U.S. Attorney General Eric Holder Friday announced the formation of a task force focused on probing residential mortgage-backed securities following President Barack Obama's call for a unit to probe the finance industry's conduct leading up to the financial crisis.

Bank of America Corp was the fourth-biggest U.S. mortgage lender in the fourth quarter of 2011, continuing its descent in the rankings after it stopped buying loans made by smaller banks.