Well, THAT just happened. The world's most dominant social network, touting some 900 million worldwide users, made its Wall Street debut from home Friday, as Mark Zuckerberg and co. opted to celebrate the beginning of a more open and connected Facebook from the company's headquarter's in Menlo Park, Calif.

Shares of Facebook (Nasdaq: FB), the No. 1 social network that raised $16 billion in its initial public offering, the biggest in Internet history, soared more than 10 percent but closed up by only a fraction.

The moment is finally here: Facebook, the world's most dominant social network with 900 million-plus users, is finally ready to make its Wall Street debut. Zuckerberg will ring the opening bell at 9:30 a.m. ET, but since he will be broadcasting from Facebook remotely, NASDAQ has provided a way to watch all the proceedings occur live.

It's Friday, May 18 and the world's largest social network, Facebook Inc., enters the market raising a whooping $16 billion in one of the biggest initial public offerings in the US history. What makes it even more eye-popping is the amount the company is now valued at - $104.2 billion.

The companies whose shares are moving in pre-market trading on Friday are: ACADIA Pharmaceuticals, Osiris Therapeutics, Morgan Stanley, Salesforce.com, Banco Santander, First Solar, JPMorgan Chase, Aruba Networks, Tata Motors and Carnival Corp.

JPMorgan Chase & Co Chief Executive Jamie Dimon has agreed to testify before Congress over the bank's recent trading losses, which have ignited a political debate over whether large U.S. banks need to be reined in by regulators or new laws.

Facebook (Nasdaq: FB), the No. 1 social network, raised $16 billion in its initial public offering, the biggest in Internet history, valuing its shares at $38.

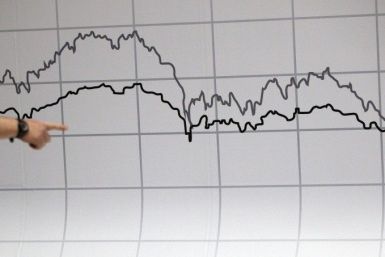

European stocks lost big Thursday as Greek banks were cut loose from European Central Bank support and Spain's borrowing costs kept skyrocketing. The head of the International Monetary Fund, Christine Lagarde, also warned today of the extremely expensive consequences of Greece leaving the currency bloc.

JPMorgan Chase & Co Chief Executive Jamie Dimon will be invited to testify before Congress over the recent trading losses announced by the bank, U.S. Senate Banking Committee Chairman Tim Johnson said in a statement on Thursday.

The world's 29 largest banks will need an extra $566 billion to comply with Basel III capital rules by the end of 2018, which could dampen their ability to increase dividends and buy back shares, according to Fitch Ratings.

One of the biggest and most anticipated IPOs of the year, quite possibly the decade, is ready to hit Wall Street tomorrow, but if you're thinking about buying shares, you're not alone. Not in the least. If you're looking to get a piece of the stock, we're here to help you. But be warned: It will not be easy.

The companies whose shares are moving in pre-market trade Thursday are: Millennial Media, Herbalife, Ctrip.com International, Cameco Corp, J.C. Penney, Wal-Mart Stores, Wal-Mart Stores, Limited Brands and JPMorgan Chase & Co.

Bruno Iksil, the trader behind the $2-billion-and-counting loss at New York-based banking giant JPMorgan Chase and Co. (NYSE: JPM) that has been the talk of New York and Washington for the past few days, will be leaving the bank within the year, the New York Times' Dealbook blog reported Wednesday.

A day before Facebook (Nasdaq: FB), the No. 1 social network holds its initial public offering, its 33 underwriters boosted the number of shares for sale by 25 percent, potentially valuing the deal as high as $19 billion.

Facebook (Nasdaq: FB), the No. 1 social network, has decided to pitch its initial public offering of 421 million shares at $38, which could raise as much as $18.1 billion, assuming ?over-allotment options.

Surging demand for shares of Facebook (Nasdaq: FB), the No. 1 social network, prompted the company to again boost the number of share for sale in its initial public offering.

Stock index futures pointed to a lower opening on Wall Street on Wednesday, with futures for the S&P 500 and Dow Jones down around 0.1 percent, while the Nasdaq 100 fell 0.4 percent at 4:10 a.m. EDT.

The FBI has opened a probe into trading losses at JPMorgan Chase & Co, stepping up the pressure on the bank after the U.S. Securities and Exchange Commission and the Federal Reserve said they were also looking into the wrong-way bets that led to the losses.

Facebook (Nasdaq: FB), the No. 1 social network, announced that it would increase the number of shares in its initial public offering, price them higher and value the company at as much as $104 billion.

The companies whose shares are moving in pre-market trade Tuesday are: Acadia Pharmaceuticals Inc, Infosys Ltd, UBS AG, JPMorgan Chase & Co, Avon Products, Inc, The Home Depot, Inc and Nokia Corporation.

As the leader of JPMorgan Chase & Co's hedging unit quit after trading losses that could end up exceeding $3 billion, the board seemed to be rallying behind CEO Jamie Dimon before the huge bank's annual shareholder meeting Tuesday.

Political discord in Greece, voters punishing German Chancellor Angela Merkel's Christian Democrats, lower euro zone manufacturing output and China freeing up cash for lending all contributed to a global stocks slide as investors pursued the safe havens of government debt and the dollar.