The exit of one or more countries from the euro zone could drive gold prices significantly higher by the end of this year, according to a Friday Capital Economics report.

Asian shares paused Tuesday as investors grew cautious ahead of monetary policy meetings by the European Central Bank and the U.S. Federal Reserve, with scepticism countering expectations for more stimulus steps to support fragile global economies.

Bank of America Corp. (NYSE:BAC), the troubled financial behemoth that teetered just above the abyss during the last few weeks of 2011 and has since made somewhat of a recovery, is expected to swing to profit when it reports quarterly financial results Wednesday morning.

What bad news does China have in store?

The Federal Reserve is charting a course for more stringent capital reserve requirements for the largest banking institutions in the U.S., in line with new international rules representing the Basel III accord.

Five years into the most significant global financial crisis since the 1930s, the world's leaders have formulated neither the fiscal policies nor the monetary policies required to deal with it, according to the Bank for International Settlements' 82nd Annual Report, which was released Sunday.

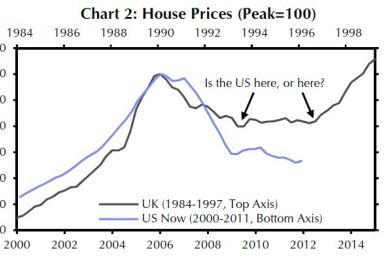

U.S. housing prices won't just hit the bottom this year -- they'll rise by 2 percent, according to a report by Capital Economics released this week. But that doesn't mean the market is in great shape.

The BRICS are expected to release data Monday on their contributions to the International Monetary Fund/European bailout package at the G-20 Summit in Mexico.

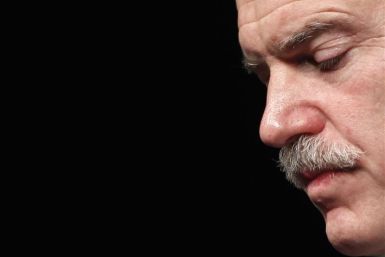

Papandreou believes that given enough time, the Greeks would be able to adhere to bailout terms.

At stake is the country's continued membership in the euro currency, and the future of the euro zone itself. Here is our handy guide to the key events and implications you can expect going forward.

EU officials have been keen to trumpet the latest euro zone Band-Aid as a triumph for collective action and an answer to critics who accused the group of acting too slowly and with not enough money in the past.

Stocks have wiped out their year-to-date gains. US payrolls are down while unemployment is up. Yields on high-demand government bonds are at record lows. Speculation abounds the US Fed might even print more money. Is it any wonder some are talking about gold?s rebound?

A famous funny-man decided to buy a small stake in the New York Mets.

Asian shares, the euro and oil prices fell Thursday as surging borrowing costs in Spain heightened fears of euro zone debt contagion.

In a direct statement overnight the European Commission has said it would consider directly recapitalizing troubled European banks via the European Stability Mechanism

The global headquarters of Dewey & LaBoeuf LLP, a glass-sheathed office tower in midtown Manhattan, has a commanding view of a stretch of Sixth Avenue looking downtown. A pair of statues, designed by artist Jim Dine, rise from the plaza of the stately office, overlooking Rockefeller Center. But now, it will be the law firm's ornate tomb, a reminder of its glory days.

Sam Zell, the Chicago real-estate mogul, has become so well-known for feasting on distressed assets that he's been called the grave dancer. This week, Zell took the nickname to the next level: He's about to receive $70 million from a ghost.

French and German consumer confidence showed unexpected strength, reports showed Friday. While the market is cheering about the good news, some economists view this as a warning sign of a euro zone crisis fatigue - something that is as dangerous, if not more so than the crisis itself.

The staff of the U.S. Securities and Exchange Commission has concluded its investigation into Lehman Brothers Holdings and will not likely recommend charges, according to the excerpt of a memo.

Sofia Vergara is now back on the market after splitting up with Nick Loeb, her boyfriend of two years. The 39-year old Colombian beauty attended Monday night's Metropolitan Museum of Art's Costume Institute Gala alone, after breaking up with Loeb over the weekend, reports The New York Post.

In its latest employment contract with CEO Aubrey McClendon, Chesapeake Energy Corp gave him permission to trade commodities for himself after he already had begun doing so.

Gold touched two-week highs on Tuesday, set for its longest stretch of daily gains in eight months, after a rally in the dollar fizzled out as investor concern escalated over the resilience of the U.S. and euro zone economies.