Wanted: Skilled executives willing to take over large, failing U.S. financial firms at a moment's notice.

The estate of Lehman Brothers paid $1.33 billion to become majority owner of Archstone, a multifamily landlord of more than 70,000 U.S. apartments, successfully blocking a rival bidder.

Europe's telecom shares have long been seen as safe houses when the wolf is at the door, but recession, fierce competition and costly network upgrades are huffing and puffing at their capacity to pay generous dividends.

Asia's economic growth may be settling into a middling pace that is too slow to provide significant global support but too fast to warrant aggressive policy easing.

European banks are preparing for a potential worsening of the region's sovereign and banking crisis, with many firms stockpiling cash and cutting back on loans to new clients as they seek to protect themselves against a possible seizing-up of financial markets.

European banks are preparing for a potential worsening of the region's sovereign and banking crisis, with many firms stockpiling cash and cutting back on loans to new clients as they seek to protect themselves against a possible seizing-up of financial markets.

In late October, as MF Global Holdings Ltd teetered toward bankruptcy, Jon Corzine phoned his close-knit circle of Wall Street friends for help.

The World Bank warned Wednesday that the global economy is on the cusp of a new financial crisis, one similar in magnitude to the chaos following the collapse of Lehman Brothers in 2008.

Commercial banks parked almost half a trillion euros at the European Central Bank, the highest on record, as the mix of debt crisis worries and a recent giant injection of ECB cash left banks awash with money but too scared to lend it.

Former customers of MF Global Holdings Ltd's collapsed brokerage were disappointed to hear on Thursday that the trustee hunting for funds missing from their accounts has no immediate plans to transfer more money to them.

Global PC shipments declined 1.4 percent in the last quarter of 2011 mainly due to weak demand in Western Europe and the United States, according to research firm Gartner.

The abrupt exit of Jasjit Bhattal, the highest-ranking ex-Lehman executive at Nomura Holdings, marks a crucial juncture for Japan's top brokerage as it decides whether to replace him with an experienced global banker to foster expansion, or with an in-house local to focus on the home market.

The estate of Lehman Brothers is battling Bank of America and Barclays in court over the sale of Archstone, the large multifamily housing landlord that real estate mogul Sam Zell's Equity Residential is seeking to buy.

2011 proved to be a sterling year for silver, according to recently released figures from the Silver Institute.

What will the year 2012 bring? Well, it looks like: the Summer Olympics in London. After that, venturing a prediction is a tough task, but here are a few.

Shaky Europe. Political gridlock. Volatile markets.

Shaky Europe. Political gridlock. Volatile markets. Familiar themes for those who lived through this year, and investors should be ready to revisit them next year.

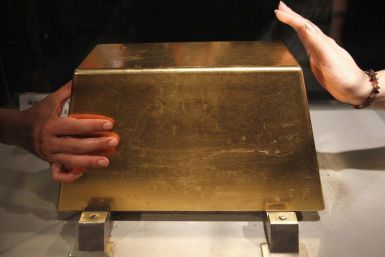

Gold extended its record bull run in 2011 for an 11th year as confidence in the world's financial leaders and their stewardship of fiat currencies plummeted.

As the end of 2011 approaches, the housing market is another year removed from the subprime mortgage meltdown. But the legacy of the crash remains, as homeowners, lenders, regulators and brokers alike continue to deal with falling home prices, a glut of unprocessed foreclosures and an uncertain economy.

Oracle Corp's earnings fell short of Wall Street's forecasts for the first time in a decade as software and hardware sales sputtered, sending its shares down more than 10 percent and stoking fears a global recession will hurt tech spending.

Oracle shares plummeted on Wednesday in German trading after the large software maker missed analysts' profit expectations for the first time in a decade.

In a spacious, luxury apartment perched on the leafy hills of Hong Kong, Kai-Yin Lo browses through a trove of Chinese art acquired over several decades, reflecting how her niche, scholarly pursuit has now hit the mainstream.