Apple Inc. (Nasdaq: AAPL) disclosed in a report 91 children under the age of 16 were found to be working last year in ten Chinese factories owned by its suppliers.

It would be safe to say you would have probably entertained the question of how to get promoted even before you graduated or left school. In my chats with juniors from my industry, I am often asked this question which I gladly answer. However, I sense they simply want short cuts to the next level.

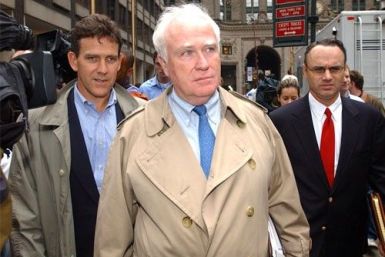

Robert Bob DuPuy, former Major League Baseball (MLB) president, has rejoined law firm Foley & Lardner's sports industry practice group in New York as a partner.

Robert W. Baird said it remains generally cautious on the post-secondary group given regulatory risk and deteriorating fundamentals.

Speculation is that Apple is due to launch a smaller and cheaper version of its iPhone to sit alongside the current and upcoming breed of iPhones.

Jefferies & Co. said the President's proposed fiscal 2012 budget, announced Monday should provide a modest boost to quite poor investor sentiment around government technology spend.

India, struggling to balance between cutting its costly fuel subsidies and curbing inflation, may tweak fuel taxes in the Feb. 28 budget to cushion the blow of rising global crude prices on state-run oil retailers.

The top after-market NASDAQ stock market gainers are: Limelight Networks, Insight Enterprises, Mercer International, Perry Ellis International, and Corinthian Colleges. The top after-market NASDAQ stock market losers are: Anika Therapeutics, Carmike Cinemas, Ultra Clean Holdings, Nasdaq OMX Group, and First Business Financial Services.

Total public U.S. debt held outstanding will continue to pile up beyond its current $14 trillion dollar level over the next 10 years under President Barack Obama's federal budget plan for 2012 unveiled on Monday.

Gold rose above $1,360 an ounce on Monday on fears that Egypt's unrest could spread across the Arab world, while silver gained 2 percent on strong industrial demand driven by signs of an improving economy.

Apple Inc. (Nasdaq: AAPL) has retained its status as the “most respected” public company in the world, as selected by a group of U.S. money managers in a survey conducted by Barron’s magazine.

RBC Capital Markets said in its skilled nursing facilities Q4 earnings preview that pre-announced upsides for the quarter and better-than-expected 2011 guidance combined with Kindred Healthcare Inc.'s (KND) fourth quarter results on the RehabCare Group (RHB) deal announcement, suggest a bright outlook in the near term under Resource Utilization Group, Version Four (RUG-IV).

President Barack Obama will push his priorities for the 2012 federal fiscal year budget on Monday. Some of the cuts include programs for low income people and education in a budget that will cut the federal deficit by $1.1 trillion over the next 10 years.

Apple is ready to plug any loopholes in its supply chain to avert shortages, as it has placed a $7.8 billion order for key components used in handheld devices from Samsung Electronics Co. for this year.

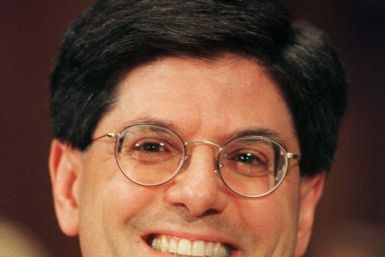

The federal Pell Grants program may witness cuts up to $100 billion, according to Jacob Lew, director of the Office of Management and Budget.

Motorola Mobility announced the acquisition of Mountain View start-up Three Laws Mobility Inc. (3LM) to expand the security of phones running on Google’s Android mobile operating system.

The proposed deal between the New York Stock Exchange Euronext and Deutsche Börse AG that would create the world's largest financial exchange has apparently run into some controversy with New York Senator Charles Schumer's unintended revelations on post-merger management authority.

Indian banks are turning to low-cost deposits, refinancing debt and raising cheap foreign capital to protect margins squeezed by higher interest rates at home, bank officials and analysts said.

Office of Management and Budget Director Jacob Lew said Sunday that the interest rate on graduate school federal loans will start building while students are still taking courses.

International automotive supplier Continental has developed a sensor (satellite) for electric and plug-in hybrid vehicles which will immediately shut off the high-voltage battery in the event of a collision.

Many U.S. consumers have no choice and are held captive to home mortgage-related companies that are often aggressively fast, commit errors in paperwork and refuse to answer questions, and whose continuing problems are holding back the country's economic recovery, a top U.S. regulator said on Friday.

Private aviation company, XOJET Inc, has announced its one-of-a-kind private aviation program called Coast2Coast.