Bank of America Corp reported a fourth-quarter profit, reversing a year-earlier loss, boosted by one-time items and lower expenses for bad loans.

Venezuela's Oil Minister Rafael Ramirez said on Sunday his country intends to exit the World Bank's arbitration hearing against ExxonMobil.

Strong bond auctions in Europe set up Wall Street stocks for a slightly higher open on Thursday, though weaker-than-expected U.S. data could cap gains.

Stock index futures rose on Thursday after well-received European sovereign debt auctions encouraged investors ahead of job market and retail sales data expected to show the economy is steadily recovering.

Bank of America Corp has put its advertising account up for review as it seeks to mold a new image for a company that has changed significantly since the financial crisis and suffered repeated blows to its brand.

Bank of America-Merrill Lynch, the second-largest U.S. bank by assets, is cutting around a fifth of its managing directors across its Asia investment banking division, sources said on Monday, in a bid to cut costs as the outlook sours in a once-booming region.

Bank of America-Merrill Lynch is cutting around a fifth of its managing directors across its Asia investment banking division, sources said Monday, in a bid to cut costs as the outlook sours in a once-booming region.

The Dutch government has appointed Credit Suisse to advise on a potential sale of its 33 percent stake in UK-based uranium enrichment company Urenco, people familiar with the situation told Reuters on Friday.

Canada gained 17,500 jobs in December, but the jobless rate rose and the new positions were all part time, further evidence its post-recession hiring surge has ended even as U.S. jobs growth finally picks up the pace.

Concern about the appetite for Eurozone sovereign debt pushed European stocks lower and hit the single currency on Thursday, with the first French bond auction of 2012 set to test how much progress policymakers have made in easing tensions.

Richard Cordray's short time as Ohio's attorney general earned him national recognition as a Wall Street watchdog.

Crude prices started their jolly ride to the top in February last year when simmering discontent in the Middle East erupted into several violent anti-government protests.

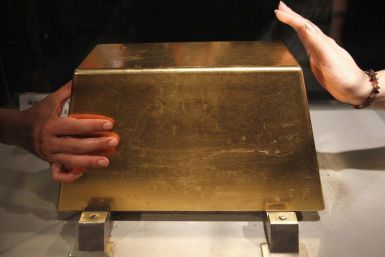

Gold extended its record bull run in 2011 for an 11th year as confidence in the world's financial leaders and their stewardship of fiat currencies plummeted.

Asia'a markets rose more than 1 percent and U.S. index futures also gained on Friday, as signs of a strengthening economy in the United States encouraged a year-end bounce for riskier assets.

The top aftermarket NYSE losers Thursday were: NV Energy, United Rentals, Suntech Power Holdings, Kronos Worldwide, Spansion, Merrill Lynch & Co, Christopher & Banks, Manitowoc, MGIC Investment and CONSOL Energy.

Japan's blue-chip index snapped a two-day winning run on Thursday and met strong resistance near its 25-day moving average, with the machine tools sector weighed down by a brokerage downgrade.

Bank of America CEO Brian Moynihan ate his words as the Charlotte, N.C.-based bank once again resorted to non-investor-friendly measures to raise capital, despite saying the bank would not take such actions.

"We believe the district court committed legal error by announcing a new and unprecedented standard" for approving settlements, Robert Khuzami, head of the Securities and Exchange Commission's enforcement division, said in a statement Thursday.

Morgan Stanley's announcement that it is slashing 1,600 jobs is only the latest in a late-year blizzard of pink slips being floated among people at the heart of American high-finance. Bonuses are also down sharply. Is the economy Grinch stealing Wall Street's Christmas?

A dash for cash has overwhelmed gold's traditional status as a haven from risk, putting the metal on course for its first quarterly fall since end-September 2008, when the global credit crunch was at its worst.

Two recent reports on the attitudes of the "mass affluent" revealed that consumers in this wealth bracket have a relatively high level of apprehension about their financial future.

Two reports released today show two groups, retail investors and professional asset managers, have been moving in markedly different directions in the past two weeks. The armchair stock pickers are getting out of U.S. equities while the pros are claiming they are dumping more cash into the American stock market.