The new investor bywords are “big data.” Initial public offerings last week for both Splunk (Nasdaq: SPLK) and Proofpoint (Nasdaq: PFPT) were smash hits because of it. Big companies like IBM (NYSE: IBM) may be the biggest beneficiaries.

In less than two weeks Samsung Galaxy S3, the successor of Galaxy S2 will be unveiled in London on the Olympic ground. However, at the same time, in the May 3 event, where the tech enthusiasts who are eagerly waiting for the next gen phone, they will also witness the launch of Samsung's latest service S-Cloud with the new device.

Another 'leaked' image of Samsung Galaxy S3 hits the Internet. Rumored features of the 4.6-inch phone will include quad-core processor running at 1.4GHz, 1GB RAM, a Mali-400MP GPU, Ice Cream Sandwich OS and a screen with 320ppi pixel density and 720p resolution. The Korean company may also introduce S-Cloud service and Galaxy tab 2 (10.1)

Nokia has been betting big on Lumia 900 ever since the company announced its plans to adopt Windows Phone as the primary platform for its smartphones. Lumia 900 eventually hit the US market through AT&T, on a $100 contract.

After the South Korean tech giant Samsung sent out press invites to an event for the launch of its much-hyped Galaxy S3 smartphone on May 3 in London, it was thought that the rumors about the device would slow down gradually. But contrary to the general belief, even more ambitious rumors have been surfacing online over the past few days.

Upbeat economic reports from Britain and Germany combined with surprisingly strong first-quarter earnings reports in the U.S. to foster a risk-on sentiment that lifted stocks and commodities while weighing on safe-haven investments.

Stocks were poised for a higher open, putting the S&P 500 on track to snap a 2-day drop, after better-than-expected results from Microsoft and General Electric Co propelled what has been a solid earnings season to date.

General Electric Co topped Wall Street's profit and revenue forecasts for the first quarter, helped by strong demand for energy equipment and railroad locomotives.

Stock index futures rose on Friday, indicating the S&P 500 may snap a 2-day decline, after better-than expected results from Microsoft and General Electric Co propelled a solid earnings season.

The companies whose shares are moving in pre-market trade Friday are: Deutsche Bank, Microsoft Corp, EDAC Technologies, Goodyear Tire & Rubber, First Solar, General Electric, Advanced Micro Devices, Riverbed Technology, Sandisk Corp and Nokia Corp.

Stock index futures rose on Friday, indicating the S&P 500 may snap a 2-day decline, after quarterly results from Microsoft and General Electric Co propelled a solid earnings season.

Futures on major US indices point to a higher opening Friday as investors awaited the earnings from major firms including General Electric Co. and McDonald's.

Since Apple introduced the first iPhone in June 2007, one question has dominated the conversation: When's the next one coming out? While Apple keeps its lips sealed until the official unveiling, there are plenty of reasons why consumers shouldn't expect a new iPhone to debut in two to three months. The iPhone 5 is coming, but it's coming in October. Here are five reasons why:

U.S. stock index futures pointed to a higher open for equities on Wall Street on Friday, with futures for the S&P 500, the Dow Jones and the Nasdaq 100 rising 0.2 to 0.4 percent.

Organizers announce that Microsoft will be the official innovation provider, working on ways to use Xbox and other technology at the GOP event.

Microsoft (Nasdaq: MSFT), the world's biggest software company, reported results Thursday that beat analyst estimates for both earnings and revenue.

Stocks closed firmly lower Thursday following a choppy start, as rumors of a possible French sovereign debt downgrade and a batch of mixed U.S. data overshadowed improving corporate earnings.

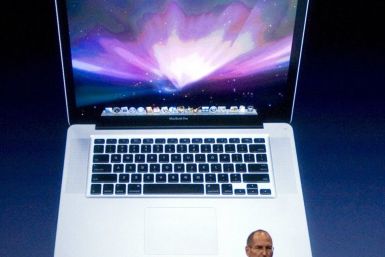

Apple will reportedly release a new lineup of MacBook Pro laptops as early as May, but many expect the advanced laptops to be unveiled in June, just in time for the Worldwide Developer's Conference in San Francisco.

Shares of Qualcomm (Nasdaq: QCOM), the biggest designer of mobile chips, plunged more than 5 percent in early Thursday trading after missing second-quarter earnings estimates.

Stocks were set to open little changed on Thursday as investors grappled with euro zone uncertainty, a raft of corporate earnings and softer-than-expected data on the domestic labor market.

Stock index futures rose on Thursday after Spain sold all of its debt at an auction and ahead of a raft of corporate earnings and economic data.

Eurosclerosis may finally have hit the technology sector.