Moody's warned on Thursday it may cut the credit ratings of 17 global and 114 European financial institutions in another sign the impact of the eurozone government debt crisis is spreading throughout the global financial system.

Moody's Investors Service placed the ratings of Bank of America Corp., Citigroup Inc. and Goldman Sachs Group Inc. on review for possible downgrade because it says the business' profitability will be diminished longer term.

Legal wrangling over the proposed $8.5 billion settlement of some of Bank of America Corp's mortgage-backed securities liability could drag through the courts for years, a top appeals court judge said during arguments in the case.

The Bank of Japan boosted its asset buying program by $130 billion on Tuesday and in the face of political pressure set an inflation goal of one percent, signaling a more aggressive monetary policy to pull an ailing economy out of deflation.

The top aftermarket NYSE losers Monday were: Masco Corp, Quantum Corp, Calgon Carbon, Brink's, Calpine Corp, HealthSouth Corp, Gol Linhas Aereas Inteligentes and Carbo Ceramics.

Gold prices climbed on Monday as news that Greece's parliament had approved an austerity bill needed to release a second round of bailout funds lifted the euro, while platinum rose back towards a three-month high as supply issues flared up.

Oil prices rose to nearly $100 a barrel in electronic trading on the New York Mercantile Exchange on Monday, after Greece's parliament approved painful austerity measures to secure a second bailout and avoid bankruptcy.

A few months ago economists were all but certain the U.S. economy would slow sharply at the start of this year, with many warning that recession risks were growing.

The BSE Sensex closed down 0.46 percent on Friday, reversing early gains, after data showed the country's industrial output in December slowed sharply and Morgan Stanley cut its allocation for emerging market stocks.

A few months ago economists were all but certain the U.S. economy would slow sharply at the start of this year, with many warning that recession risks were growing.

Surging capital inflows, booming stock markets and a fast-appreciating currency suggest the India story is again shining after a dismal 2011.

Stocks closed slightly lower on Monday as lingering questions about Europe's debt crisis and corporate earnings overshadowed growing optimism about economic growth after a five-week rally.

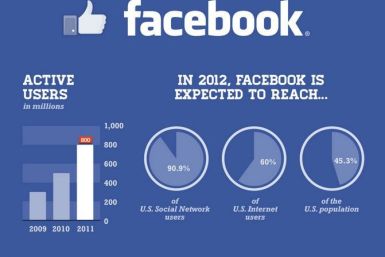

In the weeks leading up to Facebook's $100 billion initial public offering, Mark Zuckerberg reportedly told Goldman Sachs, Morgan Stanley, JPMorgan Chase and the other banks involved in the action to stop leaking information to the media.

Stocks edged lower on Monday as investors found little reason to extend a five-week rally on lingering uncertainty over whether Greece would accept the terms of a bailout.

Shares of Facebook were auctioned Thursday on the private site SharesPost that would value the entire company at $94 billion.

As pro-business groups clamor to convince regulators to overhaul their draft of the controversial Volcker rule, fault lines are emerging within the opposition over just what a revamped draft should look like.

Assuming the $100 billion initial public offering by Facebook proceeds as planned, investors will likely clamor for shares and snap them up, just as in earlier Web frenzies for Netscape Communications, Yahoo and Google. But there are dangers.

Facebook filed a $5 billion IPO on Wednesday, meaning that the social media giant will become a publically traded company, and anyone will be able to buy shares of Facebook starting this spring. But what is an IPO?

The job cuts, if they go through, would be part of thousands of other cuts which financial institutions plan to make in the near future.

Facebook filed for an initial public offering with the U.S. Securities and Exchange Commission Wednesday, for the first time doing a public financial strip tease.

Now that the Facebook filing is available, it's pretty clear that before he turns 28, CEO Mark Zuckerberg will be a billionaire. Maybe, if the IPO is as successful as hoped, he'll be worth about $28 billion.

Facebook unveiled plans for the biggest ever Internet IPO that could raise as much as $10 billion, but made it clear CEO Mark Zuckerberg will exercise almost complete control over the company, leaving investors with little say.