The companies whose shares are moving in pre-market trading on Friday are: ACADIA Pharmaceuticals, Osiris Therapeutics, Morgan Stanley, Salesforce.com, Banco Santander, First Solar, JPMorgan Chase, Aruba Networks, Tata Motors and Carnival Corp.

Asian shares fell steeply Friday after more signs emerged of growing instability among Spanish banks and political turmoil in Greece, with the latest sluggish economic data from the United States adding to the list of risks for investors.

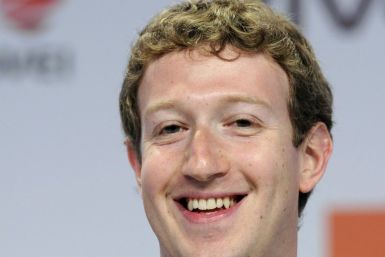

Facebook (Nasdaq: FB), the No. 1 social network, raised $16 billion in its initial public offering, the biggest in Internet history, valuing its shares at $38.

Investors who want Facebook shares when the social network goes public may have lost the opportunity. Some brokers have stopped accepting orders.

A day before Facebook (Nasdaq: FB), the No. 1 social network holds its initial public offering, its 33 underwriters boosted the number of shares for sale by 25 percent, potentially valuing the deal as high as $19 billion.

Facebook (Nasdaq: FB), the No. 1 social network, has decided to pitch its initial public offering of 421 million shares at $38, which could raise as much as $18.1 billion, assuming ?over-allotment options.

Surging demand for shares of Facebook (Nasdaq: FB), the No. 1 social network, prompted the company to again boost the number of share for sale in its initial public offering.

Facebook Inc will increase the size of its initial public offering by 25 percent to raise about $15 billion, a source familiar with the matter said, as strong investor demand for a share of the No.1 social network trumped ongoing debate about the company's long-term potential to make money.

Facebook (Nasdaq: FB), the No. 1 social network, announced that it would increase the number of shares in its initial public offering, price them higher and value the company at as much as $104 billion.

As the leader of JPMorgan Chase & Co's hedging unit quit after trading losses that could end up exceeding $3 billion, the board seemed to be rallying behind CEO Jamie Dimon before the huge bank's annual shareholder meeting Tuesday.

Facebook will close the books on its $10.6 billion initial public offering on Tuesday, two days ahead of schedule and a signal that Silicon Valley's largest IPO is drumming up strong demand.

Global bank stocks fell Monday as investors panicked that a weekend electoral impasse in Greece might be a prelude to that country to leave the 17-member euro zone.

Shares of BMC Software, which specializes in enterprise products, soared nearly 10 percent after Elliott Associates, the venerable New York hedge fund, said it has acquired a stake above 5 percent.

Gold prices fell to a 4-1/2-month low on Monday, hit by concerns about a worsening debt crisis in the euro zone following political deadlock in Greece which fuelled risk aversion and put pressure on the euro.

JPMorgan will move to limit the fallout from a shock trading loss that could reach $3 billion or more by parting company with three top executives involved in its costly failed hedging strategy, sources close to the matter said.

Bombay Stock Exchange's Sensex lost more than 100 points Monday afternoon trade as the slump in European markets and a worse-than-expected inflation for April hit the markets hard.

Since hitting 52-week lows last October, U.S. financial-sector stocks have staged a strong comeback -- rising some 34 percent. Despite this uptick, they still look like bargains, at first blush.

The companies whose shares are moving in pre-market trading on Friday are: Pluristem Therapeutics Inc, Mechel OAO, Zynga Inc, JPMorgan Chase & Co, Citigroup Inc, Morgan Stanley and Apartment Investment and Management Co.

Asian shares retreated Friday, spooked by JPMorgan's $2 billion loss from a failed hedging strategy, with investors warily watching political turmoil in the euro zone as they await new Chinese data for clues on its growth outlook.

Facebook (Nasdaq: FB), the No. 1 social network, is facing a probe into its acquisition of Instagram that could delay its $100 billion initial public offering.

Facebook (Nasdaq: FB), the No. 1 social network, has decided to pitch its initial public offering of 337.4 million shares at $35 apiece, which could raise as much as $13.6 billion, assuming over-allotment options.

Facebook, the 901-million-member social network priced its initial public offering at $35. It could be the biggest-ever IPO.