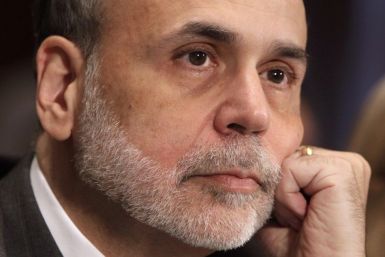

Federal Reserve Chairman Ben Bernanke said on Wednesday the central bank might need to ease monetary policy further if inflation or inflation expectations fall significantly.

The Federal Reserve's move last week to further lower borrowing costs was risky and won't significantly speed up a painfully protracted recovery, one of the officials who dissented against the decision said on Thursday.

Resale home prices rose to a record high in July, their eighth consecutive monthly gain, according to report on Wednesday that an analyst said signaled a gradual slowdown in a strong market.

Home prices in the 20-city Case Shiller Index rose for the fourth straight month in July, but the operative phrase remains: let the buyer beware. Demand conditions in most major U.S. cities remains soft, and even though home prices are attractive now, price retrenchments are possible.

European government officials and financial institutions are starting to make dramatic steps needed to manage their way through a debt crisis that threatens to drag the world economy into recession.

A millionaire developer who lived in the same central Florida neighborhood as Tiger Woods was convicted Saturday of murdering his wife in their mansion.

With European banks tanking and the U.S. growth rate grinding to a halt, how does the average investor protect his assets? By being focused.

The Dow Jones Industrial Average (DJIA) is on track to record a weekly decline of more than 800 points -- its worst weekly swoon in two years. But the important question for the typical investor is, 'Where's the Dow likely to head in the next six months?'

Two significant speeches from senior Reserve Bank officials in the past day or so have added to the arguments and view the central bank has about the current state and direction of the Australian economy, which appeared in this week's minutes of the September 6 RBA board meeting.

FBR Capital Markets anticipates that Congress will be unable to pass legislation to lower the loan limits below $625,500 until at least 2013, and expects that it could be even longer.

UBS CEO Oswald Gruebel will ask the board of the Swiss financial giant to back his leadership and keep its investment bank after a $2.3 billion loss blamed on a rogue trader piled pressure on him to scale back or even split off the division.

UBS CEO Oswald Gruebel will stress to the board of directors that he wants the investment bank to remain part of Swiss bank's "integrated banking model" in meetings on Thursday and Friday, sources said, after rogue trading cost the bank $2.3 billion.

The U.S. Federal Reserve Wednesday announced it will sell $400 billion worth of short-maturity bonds and reinvest in bonds with maturities of 6 to 30 years by the end of June 2012, in a program commonly referred to as Operation Twist.

The Federal Reserve on Wednesday looks set to launch a fresh effort to invigorate the faltering U.S. recovery, embarking on what could be the first in a series of incremental steps to foster stronger growth.

The stock price has been languishing for more than two years -- shares have lost almost half their value year-to-date.

In the second quarter of 2011, the bank lost an astounding $8.8-billion, partially due to the burden of its enormous mortgage/legal liabilities.

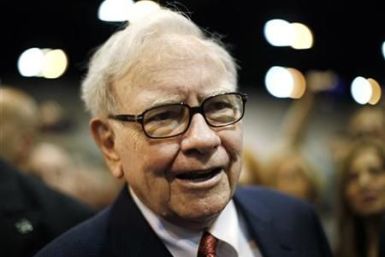

President Barack Obama is expected to make a raft of recommendations for changing tax law on Monday, in addition to his new proposed tax on the rich -- known as the Buffett tax after billionaire Warren Buffett -- which was disclosed on Saturday.

Federal prosecutors on Friday charged a Staten Island couple who bled more than more than $2.5 million in government funds from a food program meant for financing nutritious meals for preschoolers.

The jury has reached a verdict in a courtroom battle between Trust Company of the West and former investment chief Jeffrey Gundlach, concluding a six-week trial that has transfixed the financial industry.

Swiss bank, UBS AG, said it has suffered a $2 billion loss due to rogue trading and the London police arrested a 31-year-old man on suspicion of fraud.

Swiss bank UBS AG has said that it has suffered a $2 billion loss stemming from unauthorized trading even as London police arrested a 31-year-old man on suspicion of fraud by abuse of position.

UBS said a trader has lost about $2 billion in unauthorized dealing and warned it might post a loss in the third quarter, a huge blow as the Swiss bank struggles to rebuild its credibility after years of crises.