Weak jobs and housing starts data for August doused any hopes for robust growth after a bleak second quarter, underscoring its vulnerability to a struggling U.S. economy and the widening European debt crisis.

Regulators are close to an agreement with Fannie Mae and Freddie Mac to settle a case over disclosing their exposure to risky subprime loans, The New York Times reported on Thursday.

President Barack Obama proposed a $447 billion package of tax cuts and spending measures on Thursday aimed at spurring growth and hiring.

Wall Street stock futures pointed to a lower open for equities on Tuesday on renewed fears the euro zone's sovereign debt crisis is worsening, with shares seen tracking a slump in European stocks on Monday when the U.S. market was closed.

European financial markets steadied Tuesday, with the euro jumping against the Swiss franc, after a sharp sell-off a day earlier due to fears for the euro zone's future and that of its banking sector.

State prosecutors accusing major U.S. banks of improper mortgage practices have offered them a deal that may limit their legal liabilities in return for a multibillion-dollar payment, the Financial Times reported Tuesday.

Big U.S. banks in talks with state prosecutors to settle claims of improper mortgage practices have been offered a deal that may limit their legal liabilities in return for a multibillion-dollar payment, the Financial Times reported on Tuesday.

The European Union imposed a ban on purchases of Syrian oil on Saturday and targeted three Syrian firms in an expanded sanctions list meant to intensify pressure against President Bashar al-Assad's government.

Some of the nation's largest banks are under threat of a mortgage lawsuit from the federal agency that oversees the mortgage giants Fannie Mae and Freddie Mac.

European shares fell sharply on Friday, snapping a four-session rally, as traders feared U.S. non-farm payrolls numbers could signal a return to recession.

Trust Company of the West rested its court case against its former chief investment officer, star bond fund manager Jeffrey Gundlach, in the high-stakes trial that has drawn the attention of the financial services industry.

The Obama administration is considering unveiling new plans next week to revive the ailing housing market and reduce foreclosures, including an effort to help troubled borrowers refinance their mortgages.

The pace of U.S. private sector job growth slowed in August for the second month in a row, but factory activity in the Chicago area continued to expand, suggesting the economy would dodge a recession.

Bank of America Corp is looking to sell its correspondent mortgage business and the unit's employees could be notified as soon as Wednesday, the Wall Street Journal said, citing people familiar with the matter.

U.S. home prices dipped just 0.1 percent in June from May, according to Case-Shiller -- providing a ray of light that the U.S. housing market may be stabilizing.

Bank of America Corp. was sued by the trustee of a $1.75 billion mortgage pool, which seeks to force the largest bank to buy back all of the loans in the trust because of alleged misrepresentations.

Star bond fund manager Jeffrey Gundlach was in discussions to leave Trust Company of the West and succeed Bill Gross at Pacific Investment Management in 2009, according to court testimony.

Thousands of Washington lobbyists are scrambling to influence the work of a congressional super committee given the job of identifying up to $1.5 trillion in deficit reductions, with many worried about how to gain access to its 12 members.

Conventional wisdom in legal circles has long held that Goldman Sachs (GS.N) might escape further large fines or criminal charges for its role in the 2007-2009 financial crisis after reaching a $550 million settlement with securities regulators in July 2010.

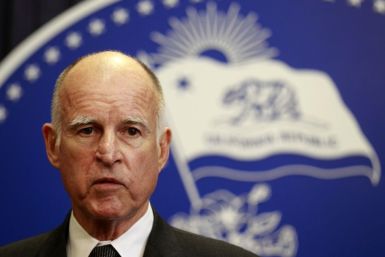

Aiming to spark job growth in California, Governor Jerry Brown unveiled proposals for tax breaks for businesses, including tax relief for companies that buy new manufacturing equipment.

Presidential candidate Rick Perry has touted Texas' thriving economy as a sign that he would make an excellent economic steward, but one of his proposals might not do so well on a national scale: a plan to let Wall Street gamble on when retired Texas teachers would die.

Trust Co of the West worked for months in secret to acquire an entire firm to replace its star bond fund manager Jeffrey Gundlach and his mortgage-backed securities department before terminating him, TCW's chief executive testified in court.