China on Wednesday increased the cost for people borrowing from a fund designed to support first-time home buyers, in line with the country's latest rise in benchmark interest rates.

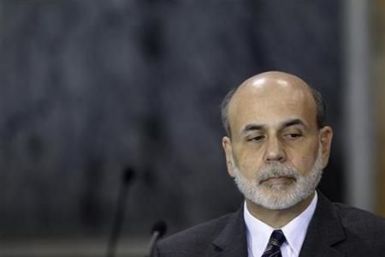

Chairman Ben S. Bernanke testimony on The Economic Outlook and Monetary and Fiscal Policy Before the Committee on the Budget, U.S. House of Representatives, Washington, D.C. February 9, 2011

RBC Capital Markets said banks with strongest capital and increased profitability are expected to get green light on dividends. The Federal Reserve is expected to approve dividend increases.

Payroll gains are the golden indicator for the US economy at this time because it reveals conditions in crucial areas and is the catalyst for the next step of the recovery process.

Bank of China Ltd and four other major state lenders will end preferential mortgage rates for first-time homebuyers in the southern boomtown of Shenzhen after the Lunar New Year holiday, a local newspaper said.

The companies whose shares are moving in pre-market trade on Monday are: Bristol Myers Squibb, Chesapeake Energy, Sprint Nextel, Valero Energy, Bank of America, Aetna, Verizon Communications, Weyerhaeuser, Nvidia and Corning.

Australia's cruel summer of cyclones and floods could generate a new, devastating political storm for Prime Minister Julia Gillard, who now must buck hostile public opinion to find a way to pay for the clean-up.

Billionaire hedge fund manager John Paulson wrote in his 2010 year end firm report that US stocks will continue to rise.

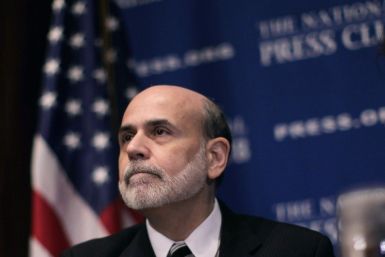

Federal Reserve Chairman Ben Bernanke's speech to the National Press Club on Feb. 3, 2011

The U.S. home loan demand rose sharply in the week ended Jan. 28, even as the mortgage rates continue to rise from their lowest levels, the Mortgage Bankers Association (MBA) said on Wednesday.

Manufacturing activity grew in January at its fastest pace since records began in 1992, and factory costs also surged, in a further sign that price pressures are building in the economy, a survey showed.

DR Horton Inc (DHI.N), the top U.S. homebuilder, reported a larger-than-expected quarterly loss, citing an increase in home foreclosures, and lingering anxiety among homebuyers that contributed to a sharp drop

Unless the U.S. addresses [its] fiscal problem, we’re going to see a train wreck, said Nouriel Roubini.

China's harsh measures to cool its booming property market is having limited impact on prices, property developer SOHO China's (0410.HK) chief executive said, underscoring the government's difficulty to curb credit growth on all fronts.

Applications for U.S. home mortgages slumped last week as bankers recorded the slowest refinancing activity in more than a year, an industry group said on Wednesday.

Applications for U.S. home mortgages slumped last week as bankers recorded the slowest refinancing activity in more than a year, an industry group said on Wednesday.

The gold naysayers are using rising rates as a way to dismiss gold. Let me explain why this belief is not only false but also utterly dangerous. First and foremost, the parameters have changed in just a few short years. Government debt has increased substantially in the last few years.

Firm's big bet on Citigroup pays off with a $1 billion gain.

Investor interest in derivatives-based strategies remains cold, as the financial bailout in 2008 and the Dodd-Graham Financial Overhaul Act has kept investors scared.

Scott Farah, the head of New Hampshire-based failed mortgage firm Financial Resources Mortgage has been sentenced to 15 years in prison by a federal judge for duping hundreds of investors.

The U.S. Treasury's toxic asset funds have gained 27 percent since they were created to help revive the mortgage-backed securities market, according to data expected to be released later on Monday.

The BSE Sensex should open higher on Monday, with heavyweights Reliance Industries and State Bank of India in focus after their quarterly results.