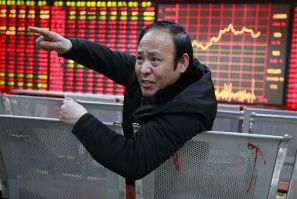

Most of the Asian markets fell in the week following the revival of the investor concerns about the deepening debt burden faced by the euro zone and worsening global economic growth.

Asian markets were mixed this week as investors continued to have concerns about the faltering global economy and the mounting debt crisis in the euro zone.

Asian markets fell this week as investor sentiment turned negative with concerns of economic slowdown in China, Japan and South Korea.

Most Asian markets rose this week as investor confidence was boosted by expectations of stimulus measures from central banks globally to regain the economic growth momentum.

Most Asian markets rose this week as investor sentiment turned positive with the announcement of measures at the EU summit in Brussels aimed at alleviating the current debt crisis gripping the euro zone.

Most Asian markets fell this week as investors were worried after the U.S. Federal Reserve refused to announce a further round of quantitative easing and the HSBC Flash Purchasing Managers Index (PMI) indicated that China's manufacturing activity was faltering.

Japan's Nikkei 225 Stock Average fell Tuesday as optimism over the Greek election results subsided and concerns over the financial stability of Spain revived.

Japan's Nikkei 225 Stock Average rose Monday as investor concerns were eased following the Greek election in which pro-bailout parties won the majority.

Asian markets rose this week amid hopes that central banks around the world will take coordinated stimulus measures to tackle the European financial crisis and regain global economic growth momentum.

Japan's Nikkei 225 Stock Average rose Friday but maintained a cautious tone as investors await the Greek elections.

Japan's Nikkei 225 Stock Average fell Thursday amid report of cut in Spain's credit rating and disappointing data from the U.S.

Japan's Nikkei 225 Stock Average rose Wednesday but maintained a cautious tone as investors have concerns of the persisting debt crisis looming over the euro zone.

Japan's Nikkei 225 Stock Average fell Tuesday as the early investor excitement on the bailout for Spanish banks subsided to revive concerns about the debt crisis looming over the euro zone.

Japan's Nikkei 225 Stock Average rose Monday as euro zone finance ministers Saturday agreed to provide Spain with aid while May exports in China grew above expectations.

China's easy money and Spain's hard choice to accept a bailout of its cash-strapped financials sector appear to have market participants feeling pretty chipper in the early going on Monday.

Asian markets rose this week amid hopes that policy makers would take concrete measures to tackle the financial crisis and regain the economic growth momentum.

Japan's Nikkei 225 Stock Average fell Friday as lack of indications of more monetary stimulus in the U.S. by the Federal Reserve undermined the interest rate cut by China.

Japan's Nikkei 225 Stock Average rose Wednesday amid positive US economic data and the G7 meeting's promise of a closer collaboration to tackle economic problems.

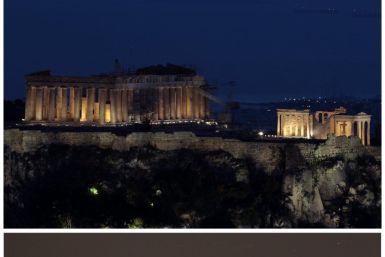

Asian, European and U.S. stocks fell hard Wednesday on rising fears and uncertainty about a possible Greek exit from the euro zone as well as concerns over slowing economic growth.

Signs that a Greek departure from the euro zone has become inevitable proliferated worldwide Wednesday with Hong Kong's main stock index plunging more than 3 percent, bank runs in Athens and Britain's central bank finalizing contingency plans for a euro zone breakup.

Asian stock markets advanced Tuesday, recovering from their biggest fall in six months in the previous session on concerns over election results in France and Greek.

Asian stock markets declined Monday after election results from Greece and France fueled concerns about Europe reviving the debt crisis.