Top-tier technology companies including Hewlett-Packard (NYSE: HPQ), IBM (NYSE: IBM), Intel (Nasdaq: INTC), Qualcomm (Nasdaq: QCOM) and Applied Materials (Nasdaq: AMAT), among others, all buy back shares. Qualcomm and Applied Materials have just refreshed their buyback programs and hiked their dividends, too.

New York is the most competitive city in the world, according to a new survey by Citigroup and the Economist Intelligence Unit.

Shares of IBM set a new high of $201.57 after new CEO Virginia Rometty said the No. 2 computer services company was “uniquely positioned” to deliver benefits of “a gusher of data” flowing into the global economy.

Barnes & Noble Inc. (NYSE: BKS) hired a chief financial officer with extensive experience in cable broadcasting, particularly with that industry's spin-offs as well as mergers and acquisitions, the New York-based company said Monday.

Veteran talk show host Larry King, 78, will get a new gig on the new Ora Internet TV site financed by Mexican billionaire Carlos Slim Helu.

Iraqi and Exxon Mobil (NYSE: XOM) officials finished contract negotiations, determining the No. 1 U.S. oil company will be paid in crude oil for the development of the country's large Qurna-1 oil field.

If reports pan out, a buyout by the Time Warner unit could be highly profitable for Mashable founder Peter Cashmore.

The hiring of Wal-Mart's Brian Cornell to run the Americas food unit and promotion of longtime executive John Compton to the new post of president might be seen as attempts to find a successor to Chairman and CEO Indra Nooyi, who has been mentioned in media reports as a potential candidate for World Bank president.

The top aftermarket NYSE gainers Friday were: Tenneco, Heckmann, Motorola, GNC Holdings and Gol Linhas Aereas Inteligentes. The top aftermarket NYSE losers were: Michael Kors Holdings, First Tennessee National, Penske Automotive Group, AvalonBay Communities and Jabil Circuit.

Mark Twain would have been amused by the remarks of new Apple Inc. (Nasdaq: AAPL) CEO Tim Cook last week when he announced the post-PC era. As Twain observed after reading his obituary, The report of my death was an exaggeration.

U.S. oil and natural gas giant Exxon Mobil has days to explain its recent exploration deals the company struck in Kurdistan back in November.

The Geneva-based trade body will uphold a ruling that Boeing got billions in dollars in unfair subsidies from the U.S. government, Reuters reported.

State, local and Federal regulators have agreed on another round of water sampling at a site in Wyoming, as they investigate claims hydraulic fracturing contaminated ground water in the area.

Thanks to the Democratic-led Senate, the vast majority of the fines paid to the Federal Government at the conclusion of the Deepwater Horizon oil spill will be used to restore the landscapes of Louisiana, Mississippi, Alabama, Florida and Texas.

“Today” co-anchor Matt Lauer will receive at least $25 million annually to remain in his seat for at least the next two years.

The world's largest cruise line operator Carnival Corp. (NYSE: CCL) swung to a loss, as rising fuel costs and one-time write downs offset an increase in revenue, while the Costa Concordia tragedy had little effect on the bottom line.

Shares of IBM (NYSE: IBM) are above $200 for only the second time in the No. 2 computer company’s 101-year history, valuing it at $232.4 billion.

U.S. employers hired more than 200,000 workers for a third straight month in February, indicating that companies are feeling more upbeat about the recovery.

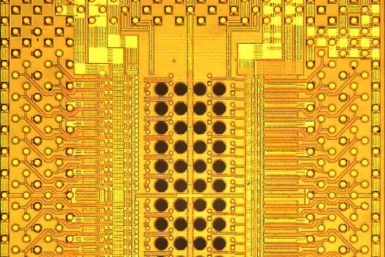

IBM researchers have developed an optical chip that can transmit as much as a terabit, or 1 trillion bits, of data per second using commercially available products -- a breakthrough that could revolutionize computing.

The top aftermarket NYSE losers Thursday were: Aeropostale, Heckmann, Alon USA Energy, Armour Residential REIT, STMicroelectronics, Active Network, Texas Industries, Polypore International, MEMC Electronic Materials and Kronos Worldwide.

The top aftermarket NYSE gainers Thursday were: Renren, Cooper Companies, Chesapeake Midstream Partners, Diana Shipping, Emergent Biosolutions, Quiksilver, Hovnanian Enterprises, Quantum Corp, Genworth Financial and Canadian Natural Resources.

The judge handling the government's case against BP (NYSE: BP) took control of the third-party claims in a $20 billion fund, removing it from 9-11 Fund administrator Kenneth Feinberg.