The companies that reported earnings before the markets open on Wednesday are: Goldman Sachs, Wells Fargo, U.S. Bancorp, State Street, Northern Trust, Bank of New York Mellon and Hudson City Bancorp.

Agribusiness behemoth Cargill Inc. said it plans to split off its majority 64 percent stake in fertilizer-maker Mosaic Co. (NYSE: MOS), in a transaction valued at $24.3 billion.

The companies which are expected to see active trade on Wednesday are Apple, Goldman Sachs, eBay, IBM, Cree, Wells Fargo, U.S. Bancorp and Xilinx.

One of the most egregious fashion trends of the past 15 to 20 years has undoubtedly been the proliferation of baseball caps – not just in the United States, but now across much of the world.

U.S. stocks climbed modestly higher, despite some negative developments with market behemoths Apple Inc. (Nasdaq: AAPL) and Citigroup (NYSE: C).

US stocks traded mixed in early trade on Tuesday following weaker-than-expected earnings from Citigroup, while declines in Apple shares dragged technology-heavy Nasdaq lower.

The delivery of Boeing's 787 Dreamliner, no stranger to delays, was pushed back again to third quarter 2011.

Banks must be allowed to fail in order for capitalism to succeed according to Paul Tucker, the deputy governor of The Bank of England (BoE).

The top pre-market NASDAQ stock market gainers are: ARIAD Pharmaceuticals, Datalink, Sterling Bancshares, China XD Plastics and Ku6 Media. The top pre-market NASDAQ stock market losers are: Apple, Avago Technologies, Cypress Semiconductor, NVIDIA and ASML Holdings.

The companies that reported earnings before the markets opened on Tuesday are: Citigroup, Forest Laboratories, Comerica, Delta Air Lines and TD Ameritrade.

Goldman Sachs (NYSE: GS) said that its American clients will be excluded from buying shares of Facebook through the financial services giant’s private placement mechanism.

Ed Miliband, leader of Britain’s Labour Party, has joined a growing chorus of critics expressing reservations over BP plc’s (NYSE: BP) joint venture with Russian energy giant Rosneft to explore potentially massive oil and gas deposits on the Arctic shelf – BP’s first major deal since last year’s Deepwater Horizon catastrophe.

Shanghai hopes to encourage foreign companies to raise capital through stock and bond issuance in Shanghai this year, Mayor Han Zheng said on Sunday, while also confirming the city plans a trial property tax during 2011.

BP is preparing to announce a major deal with Rosneft, the state-owned Russian energy giant, according to a report from the BBC.

Stocks rose modestly, boosted by strong corporate earnings from J.P. Morgan (NYSE: JPM) and Intel Corp. (Nasdaq: INTC), allowing the S&P 500 index to score its seventh consecutive week of gains.

Echoing some of the recent warnings from famed analyst Meredith Whitney, the chief executive of J.P. Morgan (NYSE: JPM) Jamie Dimon said he thinks more municipalities will face bankruptcies this year.

High-profile banking analyst Richard Bove said the U.S. banking sector is entering into a “golden age.” The financial strategist at Rochdale Securities explains that banks have so flush cash on their balance sheets that corporate earnings will grow by 20 percent annually over the next few years.

Stocks edged down on a disappointing labor market data

U.S. stocks opened lower after jobs data disappointed investors.

The market is often an anonymous place where you don't really know who is on the other side of your trade. Sometimes, however, it gets personal.

Stock rallied as banks/financials stocks pushed higher following an upgrade of the sector by Wells Fargo and a successful bond offering in Portugal.

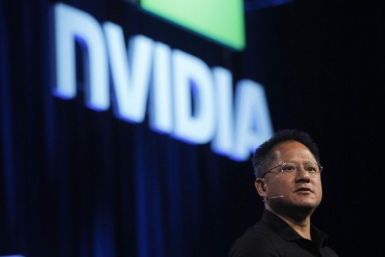

Shares of chip designer NVIDIA Corp. (Nasdaq: NVDA) are surging today, in what appears to be a delayed reaction to a series of good news surrounding the company.