Stifel Nicolaus analyst Chris Brendler downgraded American Express because their credit card businses will lose market share to debit cards.

The stock market is up slightly as Chesapeake Energy (NYSE:CHK) jumped 8.41 percent and financial stocks rose broadly. However enthusiasm was tempered by the downgrade of American Express (NYSE:AXP).

Shares of American Express Co. (NYSE: AXP) are tumbling after an analyst at Stifel Nicolaus downgraded the companies because of potential negative impact of pending government regulations.

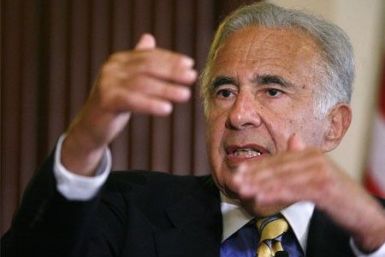

Chesapeake Energy jumped 6.95 percent at 12:09 p.m. on news that billionaire investor Carl Icahn increased his equity ownership of it from 2.5 percent to more than 5 percent.

New York-traded shares of China Eastern Airlines plunged 4.42 percent and those of China Southern Airlines plunged 2.47 percent in morning trading on tensions between North and South Korea.

Shares of SLM Corp. (NYSE: SLM) are soaring this morning, reaping the benefits of a favorable report in Barron’s over the weekend, citing that the stock looks expensive, given future earnings prospects.

Shares of American Eagle Outfitters Inc (NYSE: AEO) are sinking this morning after Susquehanna Financial Group downgraded the stock’s rating to neutral, citing a sluggish December sales picture.

Telecom bellwether AT&T announced its acquisition of wireless spectrum from chipmaker Qualcomm for $1.925 billion to strengthen its advanced 4G mobile broadband offering.

The President of Sudan Omar al-Bashir stashed away as much as $9-billion of his nation's in foreign bank accounts, according to US diplomatic cables leaked to WikiLeaks.

Stocks finished narrowly mixed in a quiet session as traders await President Barack Obama signing the tax-cut extension bill into law.

Dell Inc. (NYSE: DELL) pursuit of storage equipment maker Compellent Technologies (NYSE: CML) has featured some unusual characteristics and twists.

Nigeria has withdrawn charges against former US Vice-President Dick Cheney over a bribery scandal dating from the 1990s when Cheney was chief executive officer of Halliburton Co. (NYSE: HAL).

Shares of U.K. drugmaker AstraZeneca PLC (NYSE: AZN) are plunging after the U.S. Food and Drug Administration requested further analysis of existing studies of the company’s heart drug, Brilinta, thereby further delaying its potential approval.

Robert Mugabe, the president of Zimbabwe, has threatened to nationalize all British and American companies operating in his country unless Western sanctions are eliminated.

Chevron Corp. (CVX) negotiated with the Iranian government about developing Iraq-Iran cross-border oilfield, in direct violation of U.S. sanctions against Teheran, according to Iraqi Prime Minister Nouri al-Maliki in diplomatic cables leaked by WikiLeaks.

The companies which are expected to see active trade in Friday are Oracle, Accenture, Research In Motion, MasterCard and Lincoln National.

The top after-market NYSE gainers on Thursday are Office Depot, Accenture, Salesforce.com and American Express. The top after market NYSE most active stocks are Citigroup, Boston Scientific, Sprint Nextel Corporation and Bank of America.

Dan Mudd, CEO of Fortress Investment Group (NYSE:FIG), said the year 2011 can see record asset sales.

Stocks rose, likely boosted by a drop in jobless claims and an optimistic forecast by FedEx Corp. (NYSE: FDX), ahead of post-closing earnings reports from Research In Motion (Nasdaq: RIMM) and Oracle (Nasdaq: ORCL).

The Federal Reserve is proposing a 12-cent cap on fees merchants pay to banks pay for debit card transaction processing

AOL Inc. announced its acquisition of New York-based content marketing platform startup Pictela to bolster its advertising offering. Terms of the deal were not disclosed. Pictela is a platform for distributing videos, photos and applications across the Web in real time.

The companies which are expected to see active trade in Thursday are Oracle, Accenture, Research In Motion, Danaher, FedEx and General Mills.