U.S. retail sales growth slowed last month as warm weather earlier this year pulled shopping that normally occcurs in April into February and March, the Commerce Department said Tuesday.

U.S. stock index futures pointed to a higher open on Wall Street on Tuesday, with the futures for the S&P 500 and the Dow Jones up 0.6 percent and Nasdaq 100 futures up 0.8 percent at 0733 GMT.

Just about everything in China's economy seems to have gone backwards in April and the raft of weaker data raised fears that the world's second largest economy has yet to bottom out.

Asian shares retreated Friday, spooked by JPMorgan's $2 billion loss from a failed hedging strategy, with investors warily watching political turmoil in the euro zone as they await new Chinese data for clues on its growth outlook.

There?s been a lot of hype surrounding video game releases as of late, with titles such as ?Diablo 3? and ?Max Payne 3? quickly approaching. But what about the second half of 2012? With the holiday season being a critical time for retail sales, players should know what they have to look forward to. It?s no secret that ?Assassin?s Creed 3? will be launching at the end of October, but a list of other titles are set to launch around that time as well.

Macy's, Inc. (NYSE: M), the national retailer that counts department stores brands Macy's and Bloomingdale's in its portfolio, reported earnings Wednesday that exceeded expectations, but still disappointed Wall Street, which was looking for higher guidance from the company on future earnings.

Futures on major U.S. stock indices point to a higher opening ahead of key U.S. monthly nonfarm payrolls and unemployment data from the government.

Asian stock markets declined Friday as weaker-than-expected data on the U.S. services sector and disappointing April retail sales fueled concerns that the recovery in the world's largest economy is slowing.

Honda Motor Company Limited (NYSE: HMC) said Tuesday that U.S. sales last month fell 2.2 percent because of three fewer selling days than in April 2011, but on a selling-day adjusted basis sales actually jumped 10 percent on strong demand for Accord and Civic hybrids.

General Motors Company (NYSE: GM), the world's largest car company, reported an 8.2 percent drop in April sales on declining fleet sales and fewer selling days compared to the year before.

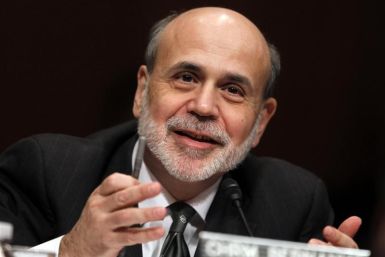

The one constant that we can rely on is the willingness of the Federal Reserve to act promptly if the data were to become unambiguously negative

Europe's chronic financial and economic troubles threaten to reach a critical level in May as warning signals emerge from the continent's core and its southern periphery.

Germany?s retail sales rose in March compared to the previous month with the boost in purchasing power in households as unemployment declined.

Asian stock markets declined Friday as sentiment was subdued after Standard & Poor's downgraded Spain's rating.

Caterpillar Inc. (NYSE: CAT), the world's largest maker of construction and mining equipment, is expected to report strong first-quarter profit on mining company demands and consumers' need to replace aging equipment.

European economic data released on Friday topped analyst expectations, giving a boost to the region's stock markets.

Asian stock markets declined for the second day Tuesday despite better-than-expected US retail sales data as concerns over Europe's debt crisis continued to weigh.

Sales at U.S. retailers rose sharply for the third straight month in March, as Americans continued to weather the hike in gasoline prices and splurged on buying new cars and renovating their homes.

Futures on major US stock indices point to a higher opening on Monday ahead of economic data including retail sales.

Growth was 8.1 percent in the first quarter, the lowest since the same period in 2009, largely due to weak global demand and reduced investment in domestic real estate.

Claims for jobless benefits rose to 380,000 last week, giving economists another piece of data to worry about after a gloomy job market showing in March. Meanwhile, a Federal Reserve report published Wednesday painted a picture of a recovery that continues to press ahead, however, modestly, amid concerns of higher fuel prices.

Same-store sales rose 0.5 percent from the previous week and 4.5 percent year on year, the International Council of Shopping Centers and Goldman Sachs reported. Redbook Research said same-store sales were up 0.8 percent from March and 4.1 percent from April 2011.