US Treasury Secretary Timothy Geithner said Thursday that China should allow its currency to increase in value against the dollar to support the reforms in the country's financial system.

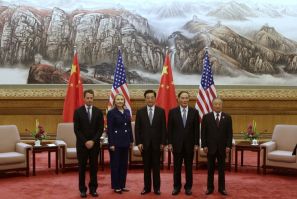

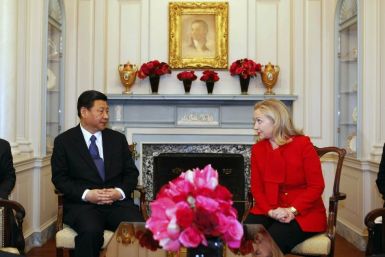

As the U.S.-China Strategic and Economic Dialogue talks are set to begin, it looks as if one issue has already been taken off the list of disagreements looming over this year's discussions.

As U.S. and Chinese leaders are set to meet in Beijing on May 3-4, a year of troubles and differences will be prominent in their minds.

A senior US diplomat arrived in Beijing Sunday ahead of schedule as the reports of US protection to escaped Chinese activist Chen Guangcheng triggered tension between both the countries.

U.S. Secretary of State Hillary Clinton and Treasury Secretary Timothy Geithner are not planning to postpone their visit to China next week because of the reported American protection of a Chinese civil-rights activist who recently escaped house arrest, a State Department official said Saturday.

China's central bank expanded the yuan's reference rate against the dollar to another record high on Friday, in a nod to calls from the U.S. to loosen growth restrictions on the currency's value.

Social Security and Medicare programs are sliding closer to insolvency, the federal government warned Monday. The Social Security trust fund will be unable under current trends to fulfill its obligations in 2033, three years earlier than projected last year

Australia, Singapore, South Korea and the UK have agreed to contribute a combined $41 billion to the International Monetary Fund reserve to boost a global firewall against Europe's debt crisis.

US Treasury Secretary Timothy Geithner pressed India’s Finance Minister Pranab Mukherjee on Thursday for reassurance that New Delhi welcomes foreign capital and remains committed to boosting bilateral trade and investment, following concerns connected to India's newly proposed retrospective tax measures.

The International Monetary Fund said Wednesday it has received pledges worth $320 billion to boost a global firewall against Europe's debt crisis.

Stocks were set to take a breather on Tuesday after the S&P 500 climbed to a 4-year high and ahead of factory orders data and minutes of the latest Federal Reserve meeting.

Stock index futures fell on Tuesday after the S&P 500 climbed to a 4-year high in the previous session as investors awaited factory orders data and minutes of the latest Federal Reserve meeting.

Kim, 52, will be the first physician to head the bank and the second U.S. nominee to have been born abroad. He has served as Dartmouth College's president since 2009.

David Cameron and Barack Obama agree deal to release strategic oil supplies from government-controlled reserves in UK and US.

Britain has decided to cooperate with the United States in a bilateral agreement to release strategic oil stocks, two British sources said, in an effort to prevent high fuel prices from derailing economic growth in an election year.

President Barack Obama and British Prime Minister David Cameron discussed the possibility of releasing emergency oil reserves during a meeting Wednesday, two sources familiar with the talks said.

Leading economies told Europe it must put up extra money to fight its debt crisis if it wants more help from the rest of the world, piling pressure on Germany to drop its opposition to a bigger European bailout fund.

With gasoline prices already approaching a distinctly unseasonal $4 a gallon in a presidential-election year, the United States is considering tapping its Strategic Petroleum Reserve as one way to control the prices of crude oil and its derivatives. Herewith is a look at past SPR loans and sales.

The United States did not openly call for a release of countries' strategic petroleum reserves during Group of 20 meetings this weekend, G-20 sources said on Saturday, although the country is considering a release from its own Strategic Petroleum Reserve to stem surging crude-oil prices.

Germany is easing its opposition to a bigger European bailout fund, officials said, smoothing the way for the world's leading economies to secure nearly $2 trillion in firepower to prevent more fallout from the euro-zone's sovereign-debt crisis.

Saudi Arabia has raised crude exports and the United States is considering releasing oil from its Strategic Petroleum Reserve as crude-oil prices hit nine-month highs on Friday and concerns deepened over Iran's nuclear program.

World economic powers at a Group of 20 gathering in Mexico City told Europe on Friday it would have to do more to fight its financial crisis before they agree to provide backup in the form of a bigger International Monetary Fund war chest.