In an attempt to further distance himself from his rival, former Massachusetts Gov. Mitt Romney, Texas Gov. Rick Perry said he will soon lay out details of his flat tax plan.

Republican presidential candidate Rick Perry said on Wednesday he will propose a flat tax as part of an overhaul of the U.S. tax code as he seeks to claw his way back to the top tier of the 2012 race.

Under the proposed terms of the settlement -- which could total $25 billion -- banks would get a broader relief from potential state civil lawsuits in exchange for refinancing underwater loans, those mortgages where borrowers owe more than their homes are worth, sources said.

The chief public finance official of the world's largest economy said Sunday that he sees a ray of light in Europe's most recent effort to stop its sovereign debt crisis. U.S. Treasury Secretary Timothy Geithner, while attending a Group of Twenty (G20) meeting in Paris, said he is encouraged by the latest effort to address the crisis.

U.S. economic growth has gained some strength, but remains too slow, and it would benefit from passage of a package of job proposals that congressional Republicans have blocked, Treasury Secretary Timothy Geithner said Saturday.

The world's leading economies kept the pressure firmly on Europe to sort out its debt crisis on Saturday with the sense of urgency to be reflected in a communique at the end of a G-20 finance chiefs' meeting.

Finance Minister Jim Flaherty voiced cautious optimism on Wednesday that Canada would be granted an exemption from an onerous U.S. tax reporting law that he called an inefficient use of capital.

Euro-zone officials are working to magnify the firepower of the region's rescue fund, European Central Bank policymakers said on Monday, while President Barack Obama piled on pressure for Europe to staunch a sovereign debt crisis that threatens the world economy.

The world's major economies on Thursday pledged to prevent Europe's debt crisis from undermining banks and financial markets, and said the euro zone's rescue fund could be bolstered.

The world's major economies pledged on Thursday to prevent the euro zone's debt crisis from undermining banks and markets but announced no new specific measures to shore up confidence in the global economy.

Europe will come under heavy pressure this week to stem its deepening debt crisis but talks among the self-proclaimed guardians of global finance are unlikely to yield bold action.

International lenders told Greece on Monday it must shrink its public sector and improve tax collection to avoid default within weeks as investors spooked by political setbacks in Europe dumped risky euro zone assets.

U.S. stocks fell sharply on Monday as renewed fears of a Greek debt default prompted investors to book some of last week's gains and turn toward the safety of U.S. government debt.

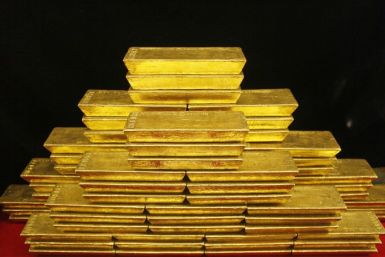

Gold fell Monday in midday trading as investors decided to diversify their safe-haven opportunities by increasing their holdings of U.S. Treasuries, the dollar and the Japanese yen, said George Cocalis, senior market strategist for PFGBEST.

Gold prices held steady Monday, as concerns about Europe's sovereign debt crisis, its weak financial sector and divisions among leaders about how to solve the crises drove investors into safe-haven securities like the U.S. dollar.

Gold prices rallied on Monday after European policy makers failed to soothe fears of Greek default and contagion to other euro zone countries, prompting investors to seek refuge in the precious metal.

Wall Street hopes for more Fed action and clear signs European leaders will follow through on their new urgency to tackle the euro zone debt crisis if U.S. stocks are to build on their best week since early July.

Stock index futures pointed to a sharply lower open on Wall Street on Monday, as renewed fears of a Greek debt default prompt investors to book some of last week's gains and turn to safer assets such as gold.

US Equity markets advanced modestly as concerns over the European debt crisis overshadowed international central banks efforts to stabilize the European monetary system.

At a meeting with E.U. finance ministers, U.S. Treasury Secretary Timothy Geithner made the case for a leveraged E.U. buyout fund ala the U.S.'s successful 2008 TALF, to help address Europe’s banking crisis, but the structure and size of any beefed-up intervention mechanism remained undetermined as of Friday night in Europe.

Geithner is currently in Warsaw, Poland to meet with Eurozone finance ministers to find a way out of the continent’s huge debt problems after more than two years of bailouts, wrecked economies and bickering.

Obama didn’t deny the account, but declined to tell Suskind what he told Geithner about this apparent breach of an executive order.