Traders woke up this morning to the quite shocking news of the US Non-Farm Payroll employment numbers.

Yesterday morning the Chicago PMI Data came in quite weak with a reading of 52.7 versus and expectation of 56.7.

A third straight month of disappointing job data clearly suggests that the U.S. labor market conditions are deteriorating again, which economists say will undoubtedly prompt more speculation that a third round of quantitative easing by the U.S. Federal Reserve is coming soon.

Friday morning's weak jobs report made it easy for Republicans to attack President Barack Obama's economic policy, quickly blaming him for the lower-than-expected 69,000 jobs added in May and an increased employment rate from 8.1% to 8.2%

Nonfarm payrolls rose by a paltry 69,000 in May, the weakest in a year, while the unemployment rate ticked back up to 8.2 percent as the labor participation rate edged up 0.2 percent to 63.8, the Labor Department said Friday. Economists polled by Thomson Reuters had called for a total gain of 150,000 jobs.

Asian shares and the euro extended losses Friday as China's factory activity data delivered its weakest reading this year, highlighting concerns the worsening euro zone debt crisis will further undermine global economic growth.

Asian shares eased Friday, with China's factory activity data and a U.S. jobs report due later in the day making investors cautious as the escalating euro zone debt crisis threatened to further undermine growth worldwide.

On a Friday afternoon in March, the New York Times Company (NYSE: NYT) disclosed to the Securities and Exchange Commission that it would pay Janet Robinson, its recently fired CEO and a 28-year veteran of the company, a severance package of around $23.7 million.

Data wise, Switzerland GDP beat forecasts by coming in at 0.7% against expectations of no change

The number of Americans filing for first-time jobless benefits rose by 10,000 last week, the Department of Labor announced Thursday, bringing the number of people filing for unemployment benefits to a one-month high and exceeding analysts' expectations.

Futures on major U.S. indices point to a higher opening Thursday, ahead of the ADP National Employment Report and the Bureau of Labor Statistics' (BLS) report on Initial Jobless Claims.

Japan's industrial production gained in April from the previous month but remained below expectation, raising concerns about the country's faltering economic growth momentum.

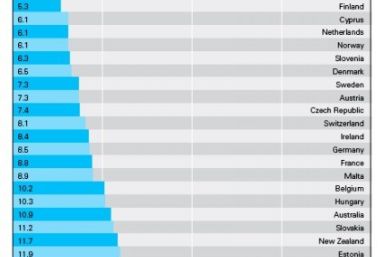

Only two of the 35 wealthiest countries have rates of relative childhood poverty above 20 percent. The United States shares the dubious honor with a former Communist dictatorship

With Europe rattling markets and the rush to dollars, traders have dragged down Brent Crude to cap-off what looks to be its worst performance in two years.

French labor unions warned Francois Hollande's government of massive layoffs, which could test the new president's economic mettle.

Americans have long been in love with Puerto Rico's high-yielding municipal bonds. Now the Caribbean island hopes they will flock to its sand, surf and spanking new resorts to help pay off massive debts.

U.S. investors came back from a long holiday weekend Tuesday to news of Spain's government aiming to stave off an apparently imminent collapse of nationalized financier Bankia S.A. -- the country's fourth-largest bank -- with a ?19 billon ($23.8 billion) capital injection.

Liberbank, Ibercaja and Caja 3, who hold toxic real estate assets of around ?11.8 billion ($14.8 billion), are at an advanced stage of merger negotiations.

Futures on major U.S. indices point to a higher opening Tuesday ahead of the report on consumer confidence for May.

Asian Markets rose Tuesday as expectations that China will take measures to lift its economic growth undermined the euro zone concerns amid Spanish banking woes.

Japan?s unemployment rate rose in April compared to previous month increasing concerns of the country?s faltering economic growth momentum.

The economic calendar is quite full this week, with most of the focus on the U.S. nonfarm payrolls report. The Institute for Supply Management, or ISM, manufacturing index and the second estimate of U.S. first-quarter gross domestic product also will draw a lot of attention.