Japan's economic conditions continued to worsen as unemployment rate rose in October and industrial production fell for the fifth consecutive month.

Below the 30-mark, RSI on both day and 4-hour charts suggest the pair is in the oversold territory and any fundamental signal showing weakness for the greenback could push the pair up to 1.320-1.327 (R1) before marching ahead to 1.336 (R2), its 38.2 percent Fibonacci. Further up, 1.344 (R3) is seen as a strong resistance for the pair.

The Office for Budget Responsibility (OBR), an independent economic forecasting entity of the British government, raised its

UK GDP forecast for this year to 1.8 percent from the previous 1.2 percent estimate.

The eurozone’s economic sentiment rose to three-year high in November, despite concerns over the sovereign debt crisis in some countries in the region.

Performance of the US dollar, Europe's periphery issues, inflation in developing world, consumption by developed ones, and of late, tensions in Korean peninsula- a lot of things are weighing on oil. The net result in recent weeks was positive for the greenback and therefore negative for oil. Still, the commodity is set to end this week with a positive note despite losing more than a dollar from its intra-week high by Friday. So, what is the trend? Where is oil heading?

As the stock market focuses its gaze upon the holiday shopping season, two of the most prominent companies in the retail sector that may attract much attention are Wal-Mart Stores Inc. (NYSE: WMT) and Target Corp. (NYSE: TGT).

Germany's argument for a policy to make private investors pick up part of the bill for any future bailouts won support from France as more European countries seem to require financial aid.

People collecting benefits from the Supplemental Nutrition Assistance (SNAP) program in the US rose by 15 million since the start of the recession in December 2007.

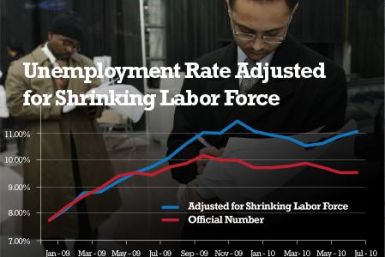

The fall in initial jobless claims in the U.S. to the lowest level since July 2008 is not a right pointer to a possible labor market recovery, according to an analyst, who says the true test for the economy is the creation of anything above 200,000 payroll jobs in a month.

Dollar, Korea, Ireland, Asian demand, inventories and technicals - a lot of things are weighing on oil now. But market participants find the question if the commodity has reached its bottom technically and on robust demand in some regions, or will a dollar rally or geopolitical developments force it break below the current range, tough to answer.

The Nitish Kumar government set the state police free in arresting criminals, unlike before when the criminals enjoyed the support of politicians.

Stephen Baker. senior industry analyst for consumer technology at NPD Group, expects that overall that consumer electronics will not perform as well as they have the past couple of years this holiday season.

comScore (NASDAQ: SCOR), an internet marketing research company, said it expects online shopping to increase by 11 percent this holiday season.

The government of Ireland has released a grim four-year austerity budget that seeks to alleviate the country's debt crisis.

Initial jobless claims were better-than-expected for the week ended Nov. 20, hitting levels that had not been seen since July 2008, the Labor Department said in a report.

Pessimistic outlook about unemployment from the U.S. Federal Reserve overshadowed reports stating the economy grew faster in the third quarter. The Fed expects unemployment to remain high over the next couple of years, hovering around 8.9 percent to 9.1 percent next year. It had previously forecast unemployment rate between 8.3 percent and 8.7 percent.

Stocks tumbled on heightened geopolitical tensions in Korea and rising fears about the spread of euro zone debt crisis. Minutes from the last FOMC meeting which revealed disagreements among policymakers over the efficacy of the second round of quantitative easing did not help market sentiment either.

According to minutes from the most recent Federal Open Market Committee (FOMC) meetings, policymakers argued over the merits of introducing a $600-billion long-term bond purchase program, but passed the measure anyway.

Minutes of the November 2-3 Federal Open Market Committee meeting.

Existing home sales in the U.S. dropped in October after two months of strong increases, the National Association of Realtors said in a statement.

The U.S. economy grew a little more than expected in the third quarter, helped by a sharp drop in imports and a rise in private inventory investment, according to the second estimate released by the U.S. Bureau of Economic Analysis.

Germany's economy grew in line with expectations in the third quarter, but remained sluggish compared to the growth in the previous quarter, according to a report from Destatis, the Federal Statistical Office of Germany.