US Adds Surprisingly Strong 128,000 Jobs In Oct Amid GM Strike

The US labor market took a hit in October from an extended strike at General Motors but the economy kept adding jobs at a solid pace, the government reported Friday.

The steady hiring showed demand for workers remained resilient despite President Donald Trump's protracted trade war with China, which has chilled investment and slowed the economy.

Employers added 128,000 net new jobs, the Labor Department reported in the closely watched monthly employment report, defying many economists who expected a sharper slowdown.

Gains in the prior two months were revised upward sharply and wages continued to climb, making the labor market picture even rosier.

Meanwhile, the jobless rate rose a notch to a still-low 3.6 percent, as expected. The 3.5 percent unemployment rate in September was the lowest since 1969.

While the GM strike weighed on jobs, the increase in the unemployment rate reflected growth in the labor force as 325,000 people came off the sidelines to look for work.

Nearly 50,000 GM workers were called back to work this week following a 40-day strike, but not before the stoppage put a deep dent in October's auto industry employment levels.

The ranks of auto workers shrank by more than 41,000, according to the report -- the biggest drop in that sector since October 2009, when the American auto giant was on the brink of collapse.

Without the impact of the GM strike, employment in the US manufacturing sector would have risen in October and overall payrolls would have risen by around 170,000 net new positions, matching the average of the prior six months.

The news sent Wall Street higher, with the S&P 500 and Nasdaq finishing at records, while Trump hailed the news on Twitter, calling it a "blowout" number.

"This is far greater than expectations. USA ROCKS!" he wrote, claiming that, adjusted for the prior months' revisions and the GM strike, October's report showed a total of 303,000 new jobs.

But in fact, even counting the revised August and September figures, which adds 95,000 to the total, and discounting the GM impact, the net increase is still only 264,000.

The White House's questionable calculations drew swift and sharp criticism from economists and other critics on Twitter.

"The idea that the administration would make up its own estimate like this is wrong on so many fronts," Diane Swonk of Grant Thornton tweeted. "Economists and statisticians who report accurate data are jailed in countries that do this - I have known several."

Hiring was also strong in other sectors, averting the dire outcomes some economists had predicted, as bars, restaurants and financial services companies continued to snap up new workers.

Wages rising

The gains came even though federal government hiring of temporary workers for the 2020 census ended, removing the temporary boost of prior months.

But overall job growth has slowed in 2019 to a monthly average of 167,000, compared to 223,000 last year, as the supply of available workers dwindles and skittish companies hold off on adding workers amid concerns about the US-China trade war.

But low unemployment and steady job growth should continue to support consumer spending, which represents the lion's share of US economic activity.

Compared to October of last year, worker pay rose three percent, meaning year-on-year wage gains have been at or above three percent for 15 straight months.

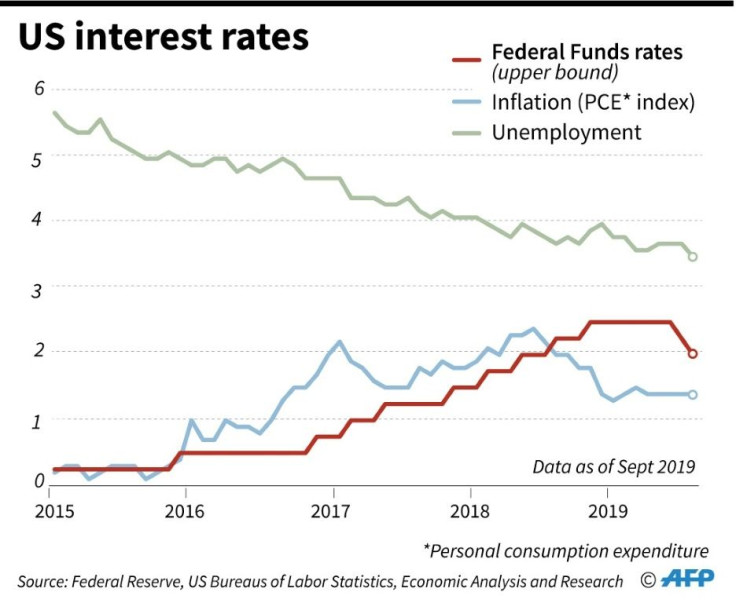

The Federal Reserve this week cut interest rates for the third time in a row, moving to shield the economy from a global slowdown and the effects of the trade wars and other factors slowing the US and global economies.

But Fed Chairman Jerome Powell signaled Wednesday the central bank likely will hold off on providing further stimulus.

Ian Shepherdson of Pantheon Macroeconomics said the October result was "good but the future is much darker."

Forward-looking business surveys say payrolls could soon slow to around 50,000 per month, he said in a client note.

© Copyright AFP 2024. All rights reserved.