With US Auto Sales Reports Due Friday, Some Experts See Reasons To Be Wary Of Bubble

(Reuters) - The U.S. auto industry hasn’t appeared so healthy for years. Sales hit an eight-year high in June, there appears to be plenty of pent-up demand, and discounting is far from getting out of hand. New plants and production lines are being built, and many auto executives, dealers and securities analysts are optimistic.

And yet, a minority on Wall Street and in the autos business are seeing reasons to be wary. They argue that a combination of cheap loans with extended terms, deep incentives from some dealers, and unsustainably high values for used cars, is making it far too easy for many Americans to buy new vehicles.

Demand, they argue, is being artificially pumped up. And, if the U.S. Federal Reserve raises interest rates next year as expected, it will raise the costs of buying a car and could trigger a slowdown in demand.

Among those seeing a glass half empty is Morgan Stanley auto analyst Adam Jonas who says we may be heading towards what he terms “peak auto.”

Jonas, one of the industry's top analysts based on Institutional Investor's 2013 annual rankings, says that cheap and extended loan terms and inflated residual values on leases are making it far too easy for many Americans to buy new vehicles.

“We have little doubt that we’re in bubble territory,” he said in an interview. “We’ve blown through prior (sales) peaks in terms of value, the amount of money people are spending on automobiles. We’re in uncharted territory right now.”

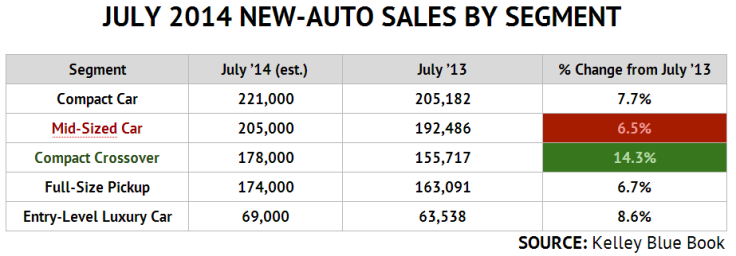

When figures for July auto sales are released on Friday, growth is expected to show a slight dip to a 16.7 million annualized rate from 17 million in June, according to economists polled by Thomson Reuters. Full-year sales forecasts are now ranging from 16.2-16.4 million, compared with 15.6 million in 2013 and are set to hit the highest level for a year since 2006.

Even Jonas doesn’t expect a drop off in demand anytime soon. He sees U.S. sales reaching a record 18 million in 2017, driven by easy credit. However, by 2019 he sees sales sinking to just 14 million.

“We are clearly pulling forward demand from the future,” said Jonas.

LOWER CREDIT SCORES

The U.S. Office of the Comptroller of the Currency, which regulates national banks, said in a June report that “signs of risk in auto lending are beginning to emerge.” The assessment was based on lenders’ willingness to lengthen terms, to chase borrowers with lower credit scores and to offer loans that exceed the value of the vehicle.

General Motors Co (NYSE:GM) is among several automakers recording growth in subprime lending, to borrowers with credit scores of less than 620. Those buyers now represent 14-15 percent of the mix at GM, compared with the industry average of just under 13 percent.

“Longer-term loans continue to dominate the market,” said Melinda Zabritski, senior director of credit data firm Experian Automotive, although she said loan delinquencies are “near historic lows.” The average term of a new-vehicle loan this year has risen slightly to 66 months, with vehicle manufacturers routinely offering zero-percent financing for 60-72 months, and some lenders extending terms to 84 months, or seven years.

Jonas believes easy credit terms are fueling record transaction prices, which now average more than $30,000. Buyers are financing about $27,600 on average, according to Zabritski, nearly $1,000 more than a year ago.

LITTLE DIPS

Still, many in the industry say they believe consumer demand will continue to drive growth.

“We’re exiting a very long recession, and that means there is still pent-up demand,” said Steven Szakaly, chief economist for the National Automobile Dealers Association

Rodney O'Neal, chief executive of auto parts supplier Delphi Automotive said: "When you look at the replacement needs, the math says it hasn’t reached its peak.”

And Jeff Skobin, marketing manager at Los Angeles mega-dealer Galpin Ford, sees little reason for concern: “We’ve had little dips and spikes here and there, but we don’t see any indicators of a major fall-off coming — no red flags, nothing that points to a big shift in our business.”

The incentives being offered by the automakers have been relatively stable. When the automakers begin to discount heavily, it is often a sign that there are too many vehicles being produced and that underlying demand isn't keeping up. The hit to margins soon hurts their profits.

“Manufacturers are holding back” on rebates and other incentives, said Charles Chesbrough, senior principal economist for research firm IHS Automotive. “There is still a lot of margin to give away if they really want to move sales.”

IHS sees U.S. sales peaking at 16.75 million in 2017 and tapering off slightly to 16.44 million in 2020.

Anil Valsan, lead analyst on Ernst & Young’s global auto team, says manufacturers have been “fairly disciplined” about applying incentives to boost sales, unlike during the recession when there were “huge inventories” of unsold vehicles at dealers, auto plants were operating at well below capacity and “incentives were the only way to move stock.”

Now, says Valsan, inventories are at a healthy and manageable level and capacity utilization is near peak — about 90-95 percent, according to industry estimates.

What that means, adds Valsan, is that “we will probably not see a crash, but we will see a cooling in demand, a plateauing of the market.”

BIG DISCOUNTS

While incentives from vehicle manufacturers may seem relatively modest, a Reuters survey on Thursday of U.S. auto dealers’ websites indicated there is heavy discounting going on at many dealers across the country. Some of it supported by the manufacturers but much of it coming out of the dealers’ own pockets.

For example, discounts run as high as $20,000 on the Cadillac ELR hybrid sports car. Some Ford and Chevrolet dealers are advertising massive discounts of $10,000 and more on their full-size pickup trucks and sport-utility vehicles. At least one Hyundai dealer is offering $8,000 off the price of a Genesis luxury sedan, while the discount on a Cadillac XTS sedan ranges up to $10,000.

Jeff Schuster, senior vice president of forecasting at LMC Automotive, believes “much of the recovery has taken place” in the auto industry and sales growth will slow.

But “Detroit is in a much better position to weather such issues,” says Schuster. “The industry’s cost structure and discipline will allow some wiggle room if the market goes bad.”

Morgan Stanley’s Jonas isn’t as relaxed.

Cheap money “is like a drug,” says Jonas. “It’s an aphrodisiac” that is artificially inflating demand. The aftermath won’t look pretty, he adds.

“We think the next 10 years” in the auto industry “are going to be more brutal than the last 10 in almost every way.”

(Additional reporting by Peter Rudegeair; Editing by Martin Howell)

© Copyright IBTimes 2024. All rights reserved.

Join the Discussion