US Fed Faces Balancing Act In Delivering Rate Cut

The Federal Reserve is widely expected to announce its third interest rate cut of the year on Wednesday but a solid economic growth report complicates the picture and likely will produce a split decision.

As President Donald Trump's trade war with China has hit manufacturing and created uncertainty that together with concerns about Brexit have slammed the brakes on investment, economists expected another move from the Fed to help bolster a softening American economy.

But GDP in the July-September quarter was surprisingly solid, growing 1.9 percent, boosted by a strong housing sector and healthy consumer spending.

That adds strength to the voices calling on the central bank to pause to see how things play out and Fed chief Jerome Powell faces an even more delicate task of explaining the decision and managing investor expectations about the next steps.

The Fed announcement is due at 1800 GMT, and Powell scheduled to hold a news conference 30 minutes later.

Alongside the complex economic picture, policymakers also face relentless pressure from Trump who has kept up a steady campaign bashing the central bank, saying on Twitter this week that it "doesn't have a clue!"

"We have unlimited potential, only held back by the Federal Reserve."

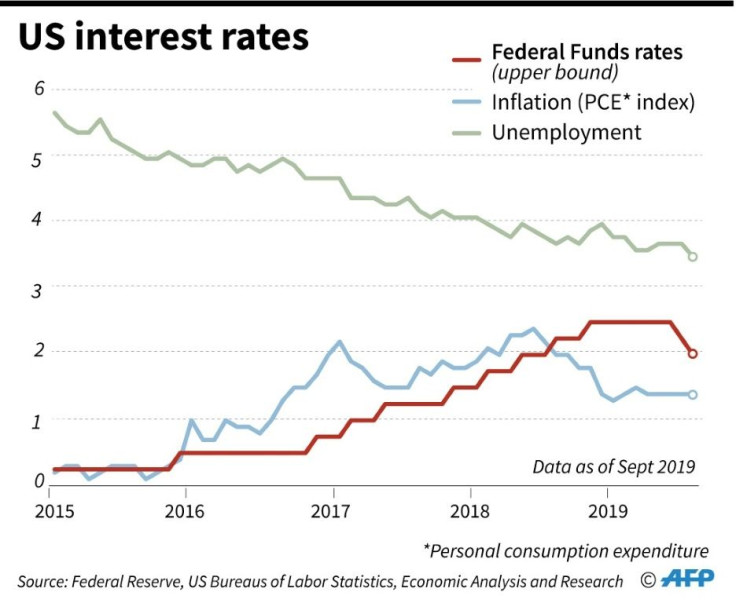

The Fed so far has rolled back two of the four increases implemented last year in the key borrowing rate when the economy seemed to be strengthening, before the tariff battles with China and Europe began to slow activity and freeze investment.

The president's demands for more stimulus notwithstanding, some influential voices are calling for a pause so the Fed can assess global economic and trade developments.

There have been some positive signs recently, as the United States and China say they have reached another truce in trade war while a no-deal Brexit now appears less likely.

But those developments could just as easily turn sour, which means Powell will have to balance whether to signal a pause in rate cuts or hint that the central bank will continue the easing cycle.

"Unfortunately, I think clear communication by Jay Powell to the markets has been a bit of a challenge for him, particularly when he speaks extemporaneously or off the cuff," Kathy Bostjancic, chief US financial economist at Oxford Economics, told AFP.

Fed members split

The Fed chairman has struggled on prior occasions to send clear-but-nuanced signals.

He declared July's rate cut was a "mid-cycle adjustment," a head-scratcher that markets initially thought meant the Fed would go no further.

Diane Swonk, economist at Grant Thornton, has called for a pause but noted that some Fed officials will oppose the decision no matter which way it goes.

"Growth pleasantly surprised on the upside in the third quarter, which deals another blow to the rationale for a Federal Reserve rate cut today," she said.

"Look for at least two dissents if the Fed decides to move ahead and cut rates a third time this year."

At the September FOMC meeting, three officials dissented, two who opposed a move and one who wanted a bigger rate cut.

Since then, the normally dovish Charles Evans of the Chicago Federal Reserve Bank said interest rate policy is already "in a good place" as it is.

But Dallas Fed President Robert Kaplan, who in January will become a voting member of the Fed's rate-setting Federal Open Market Committee, said policymakers should avoid suggesting they will stop providing stimulus.

"This is a really fragile time where this could break either way. The jury is still very much out," he said, according to The Wall Street Journal.

Powell is unlikely to signal a "hard stop" either, preferring to keep options open, Bostjancic said in comments prior to the quarterly GDP data's release.

"They'll keep the phrase 'we'll act as appropriate' to sustain the expansion but at the same time at the press conference he can emphasize that it's a meeting-by-meeting basis," she said.

© Copyright AFP 2024. All rights reserved.