U.S. High-yield Bond Funds Draw Cash As Recession Fears Ebb

U.S high-yield bond funds are attracting heavy investments, a turnaround from the selloffs of the first half of this year, as investors bet that the Federal Reserve will limit future interest rate hikes to try to avert an economic slowdown.

Fund managers are also increasing their investments in junk bonds to take advantage of widening yield spreads, as bonds trade at steeper discounts than at the start of the year.

Refinitiv data shows U.S. high-yield bond funds received an inflow of $4.8 billion in July, the first monthly inflow in 2022.

GRAPHIC: US high yield bond fund flows (

)

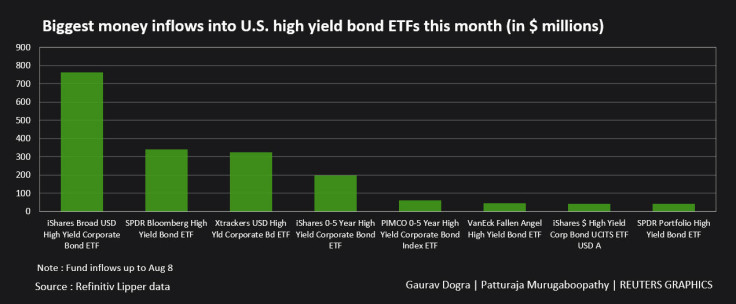

So far in August, U.S. high-yield bond ETFs increased by $2.18 billion, the data showed.

GRAPHIC: Biggest money inflows into US high yield bond ETFs in July (

)

"High-yield bond funds are getting inflows due to enthusiasm that the U.S. economy will avoid a recession or, if it does have one, that it will be mild," Thomas Samuelson, chief investment officer at Vineyard Global Advisors, said.

"Less severe recessions cause less stress on corporate cash flows and thus fewer defaults of riskier high-yield bonds."

U.S. high-yield bond funds witnessed a cumulative outflow of $52.25 billion in the first half of this year, as the U.S. central bank raised its interest rates aggressively to tame soaring price pressures.

But a drop in commodity prices in recent weeks has reduced expectations of higher inflation.

The ICE BofA U.S. High Yield Index, a benchmark for the junk bond market, has risen by more than 7% since July, after declining 14% in the first half of this year.

The yield spread between the junk bond index and U.S. Treasuries stood at 452 basis points on Thursday, much higher than 285 basis points at the start of the year.

TOO SOON FOR 'ALL-CLEAR' SIGN

Some fund managers said high-yield bonds also helped to diversify portfolios and had provided some safety meaning many firms issuing junk bonds had stronger balance sheets.

CreditSights data found the U.S. high-yield distress ratio, a measure of risk in the bond market, declined to 10.6% in July, from 15.2 in June, suggesting default rates are moderating.

"Structurally, we are seeing high-yield asset allocators being more dynamic on how they are allocating using core/satellite approaches which is common in equity, but was not common in high-yield bonds," said Manuel Hayes, senior portfolio manager at Insight Investment.

Some investors are still wary.

"We think it's too soon to plant the 'all-clear' sign .." said Vineyard's Samuelson.

"We are maintaining our underweight position on high-yield bonds until we see more evidence that the Fed is closer to the end of its tightening cycle and the risk of a recession subsides."

© Copyright Thomson Reuters 2024. All rights reserved.