US Industrial Output Rebounds Sharply In November

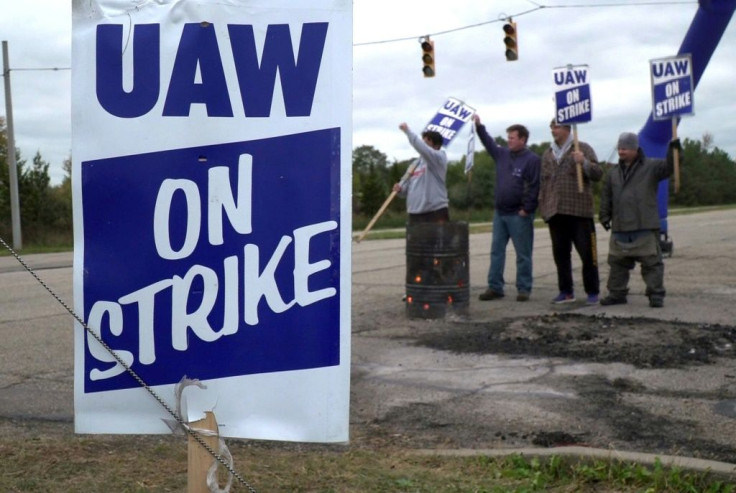

American industry saw production jump in November following the end of the nationwide strike at General Motors, the Federal Reserve reported Tuesday.

But even discounting the effects of the end of the work stoppage, industrial output posted a solid gain after many disappointing months, according to the data.

The Fed's industrial production index surged 1.1 percent, rebounding even more than expected, posting the biggest increase since May 2010. That more than erased the 0.9 percent decline in October.

Manufacturing also jumped 1.1 percent in the month, the biggest gain since February 2018, according to the report.

"These sharp November increases were largely due to a bounceback in the output of motor vehicles and parts following the end of a strike at a major manufacturer," the Fed said.

Nearly 50,000 GM workers walked off the job nationwide in mid-September, staging a six-week strike, the longest work stoppage to hit the automaker in decades.

Production of motor vehicles and parts last month jumped 12.4 percent.

Excluding the auto sector, total output still rose 0.5 percent, while manufacturing increased 0.3 percent, which is a positive sign since the sector has seen declines in seven months this year.

But even with the upbeat news, total industrial production and manufacturing output are each 0.8 percent lower than in November 2018.

The oil industry also continued to slow, causing mining output to slip another 0.2 percent. But utilities jumped 2.9 percent.

Meanwhile, factory capacity in use fell to 77.3 percent, the lowest since October 2017, and well below the average of the last five decades.

Companies nationwide have reported struggling to find workers, which may slow their expansion, but also for over a year have been delaying or canceling investment due to President Donald Trump's trade war with China.

Surveys of the manufacturing industry show the sector has been slowing for seven months, and confidence has been in the doldrums.

"The trade war currently isn't hitting activity as hard as it's hitting sentiment, though we don't know if this can last," economist Ian Shepherdson of Pantheon Macroeconomics said in an analysis.

And the phase one trade deal with China announced last week to much fanfare following nearly two years of conflict is unlikely to boost the industry, he said.

"The trade deal agreed last week does little for manufacturers, leaving in place the 25% tariffs on most imported Chinese capital and intermediate goods."

The accord canceled or reduced US tariffs on products like mobile phones, computers, toys and clothing, which would hit American pockets hardest.

But the duties on $250 billion other goods remain in place.

© Copyright AFP 2024. All rights reserved.