US Inflation Eases Slightly To 8.5% In July As Fuel Prices Dip

US inflation eased slightly in July, official data showed Wednesday, taking pressure off the Federal Reserve to hike interest rates sharply while bringing a much-needed boost to President Joe Biden just months before crucial midterm elections.

With energy costs dropping in recent weeks, the CPI dipped to an annual rate of 8.5 percent last month, the Labor Department reported.

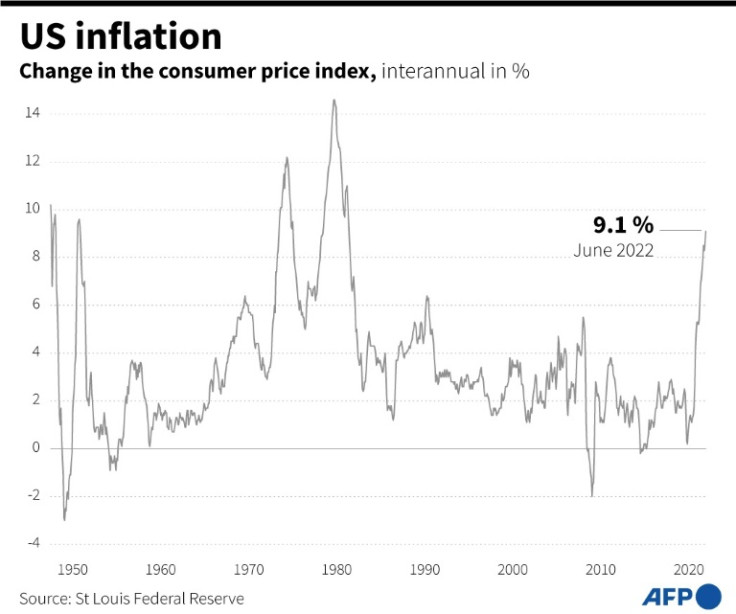

Fueled by aggressive consumer spending of pandemic savings, global supply chain snarls, domestic worker shortages and Russia's war on Ukraine, the consumer price index had soared 9.1 percent on-year in June, the highest in 40 years.

But July's consumer price index was unchanged compared to the month before, well below a forecasted increase, while CPI excluding volatile food and energy goods rose just 0.3 percent -- the smallest in four months -- the figures showed.

Consumer prices have continued to climb in the United States, squeezing family budgets and, by extension, Biden's popularity.

His opponents accuse the president of precipitating inflation with his gigantic $1.9 trillion coronavirus relief package, which he enacted in March last year shortly after assuming office.

And Republicans renewed their criticism of Biden's economic policy, warning that Sunday's passage in the Senate of his massive climate and healthcare bill titled the "Inflation Reduction Act," would do the opposite of its stated purpose.

But the devil is in the details.

Experts worry that the inflation slowdown linked to the drop in gasoline prices could be outweighed by rising rent and real estate prices.

"The larger issue is what happens to home ownership costs & rents," Diane Swonk, chief economist for KPMG, wrote on Twitter.

The question now facing Washington is whether it will be possible to bring inflation down sustainably, without plunging the world's largest economy into recession, after two quarters of economic contraction.

In a bid to tamp down inflation, the Fed has already hiked the interest rate four times to a range of 2.25 to 2.5 percent, including 75-basis-point increases at each of the past two meetings.

Fears that Wednesday's reading would come in above forecasts, pushing the central bank to unveil another jumbo hike, weighed on equities in Asia and Europe, with most markets in the regions falling into the red.

On the bright side, the US labor market remains dynamic and in July the unemployment rate fell to the pre-pandemic level of 3.5 percent.

But there are still nearly two jobs open for every available worker, which pushes wages up and contributes to inflation.

© Copyright AFP 2024. All rights reserved.